あすつく対応 「直送」 フクダ精工 SLD22 超硬付刃スリムシャンクドリル22 SLD-22 332-0944

(税込) 送料込み

商品の説明

商品情報

■■■■■ご購入前に必ずご確認ください■■■■■

12499円あすつく対応 「直送」 フクダ精工 SLD22 超硬付刃スリムシャンクドリル22 SLD-22 332-0944DIY、工具道具、工具CAINZ-DASH】フクダ精工 超硬付刃スリムシャンクドリル22 SLD22

PC ⇒ 商品ページ下部の【商品説明】の内容

スマホ⇒「すべて見る」をタップし【商品説明】の内容

■■■■■■■■■■■■■■■■■■■■■■■■

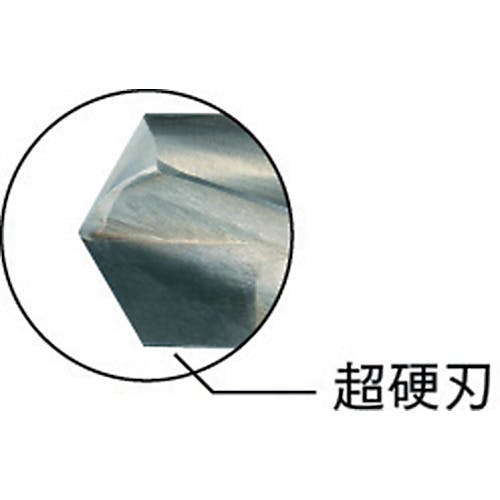

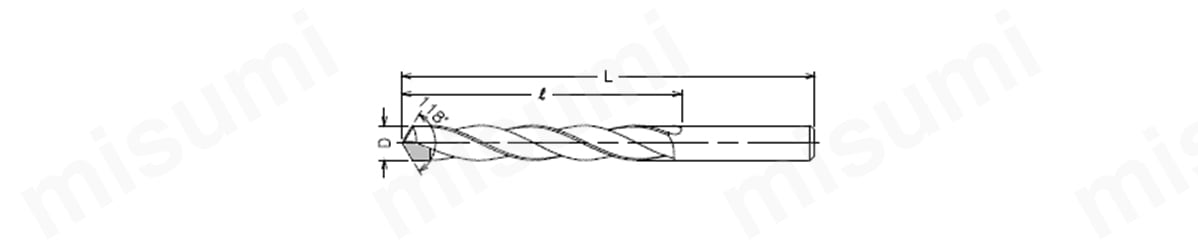

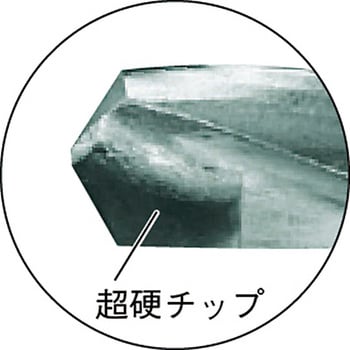

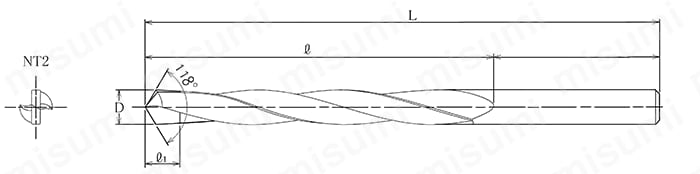

【特長】 ●シャンク径は12・16・20mmのストレートシャンクに統一しているため、使い勝手がよく高精度な穴あけ加工が可能です。 ●刃長、シャンク長、全長をすべて統一にしているため、ドリルのサイズ交換時の手間が軽減されます。 ●MC、NC機に最適です。 【用途】 ●被削材:鋳鉄、非鉄金属。 【仕様】 ●刃径(mm):22 ●溝長(mフクダ精工 FKD 超硬付刃スリムシャンクドリル22 SLD22 1本 332-0944

フクダ精工 FKD 超硬付刃スリムシャンクドリル22 SLD22 1本 332-0944

FKD 超硬付刃スリムシャンクドリル22 SLD22

フクダ精工 FKD 超硬付刃スリムシャンクドリル22 SLD22 1本 332-0944

フクダ精工 FKD 超硬付刃スリムシャンクドリル22 SLD22 1本 332-0944

フクダ精工 FKD 超硬付刃スリムシャンクドリル22 SLD22 1本 332-0944

CAINZ-DASH】フクダ精工 超硬付刃スリムシャンクドリル22 SLD22

超硬付刃スリムシャンクドリル フクダ精工(FKD) ノスドリル(段付ドリル

FKD 超硬付刃スリムシャンクドリル22 SLD22

超硬付刃スリムシャンクドリル フクダ精工(FKD) ノスドリル(段付ドリル

フクダ精工 FKD 超硬付刃スリムシャンクドリル22 SLD22 1本 332-0944

CAINZ-DASH】フクダ精工 超硬付刃スリムシャンクドリル22 SLD22

超硬付刃ストレートシャンクドリル フクダ精工(FKD) 超硬ストレート

超硬付刃ストレートシャンクドリル

SG フラットドリル SGEZ

超硬付刃ストレートシャンクドリル | フクダ精工 | MISUMI(ミスミ)

超硬鋼用ソリッドドリル(強力型) 2D用 岡崎精工 超硬エンドミル

FKD 超硬付刃テーパーシャンクドリル20.2 TD20.2 フクダ精工|F.K.D

超硬付刃スリムシャンクドリル フクダ精工(FKD) ノスドリル(段付ドリル

超硬付刃ストレートシャンクドリル | フクダ精工 | MISUMI(ミスミ)

超硬付刃ストレートシャンクドリル

超硬付刃ストレートシャンクドリル | フクダ精工 | MISUMI(ミスミ)

SD 3.5 G2 超硬付刃ストレートシャンクドリル 1本 フクダ精工(FKD

超目玉枠】 フクダ精工/F.K.D 超硬付刃スリムシャンクドリル 23mm

超硬付刃ストレートシャンクドリル | フクダ精工 | MISUMI(ミスミ)

超硬付刃ストレートシャンクドリル | フクダ精工 | MISUMI(ミスミ)

CAINZ-DASH】フクダ精工 超硬付刃スリムシャンクドリル22 SLD22

超硬付刃スリムシャンクドリル22 SLD22 フクダ精工製|電子部品

超目玉枠】 フクダ精工/F.K.D 超硬付刃スリムシャンクドリル 23mm

超目玉枠】 フクダ精工/F.K.D 超硬付刃スリムシャンクドリル 23mm

超目玉枠】 フクダ精工/F.K.D 超硬付刃スリムシャンクドリル 23mm

超目玉枠】 フクダ精工/F.K.D 超硬付刃スリムシャンクドリル 23mm

超目玉枠】 フクダ精工/F.K.D 超硬付刃スリムシャンクドリル 23mm

マキタ A-54938 3Dプラス超硬ドリル(SDSプラスシャンク)全長470mm

シリコーン潤滑グリース

ハンマードリルSDXMAX充電式 | 商品別一覧>穴あけ・斫り・杭打

SGEZ22.0 | SG フラットドリル SGEZ | 不二越 | MISUMI(ミスミ)

SD 3.5 G2 超硬付刃ストレートシャンクドリル 1本 フクダ精工(FKD

ハンマードリルSDS28MM集塵40V本体 | 商品別一覧>穴あけ・斫り・杭打

SGEZ22.0 | SG フラットドリル SGEZ | 不二越 | MISUMI(ミスミ)

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています