ノートパソコンアクセサリー 2枚セットLenovo IdeaPad L340 Gaming 17.3インチ 2019年モデル用4wayのぞき見防止液晶保護フィルム 画面

(税込) 送料込み

商品の説明

商品情報

【カテゴリー】

21562円ノートパソコンアクセサリー 2枚セットLenovo IdeaPad L340 Gaming 17.3インチ 2019年モデル用4wayのぞき見防止液晶保護フィルム 画面スマホ、タブレット、パソコンディスプレイ、モニターAmazon.co.jp: LOE(ロエ) 14インチ (3:2) ノートパソコン 保護フィルム

液晶保護フィルム、シート(PC用)

【商品名】

2枚セットLenovo IdeaPad L340 Gaming 17.3インチ 2019年モデル用4wayのぞき見防止液晶保護フィルム 画面

【ブランド】

ClearView(クリアビュー)

【商品説明】

・★AG加工で映り込みを拡散し、ギラツキを抑え、画面を見やすくします。

・★上下左右4方向(360度)からの視野を制限する特殊ブラインド加工が施されており、周りからの視線を防ぐプライバシー保護フィルムです。(透過率62%)

・★硬度の高いハードタイプフィルムで、液晶画面を汚れ、キズ、ホコリから保護します。

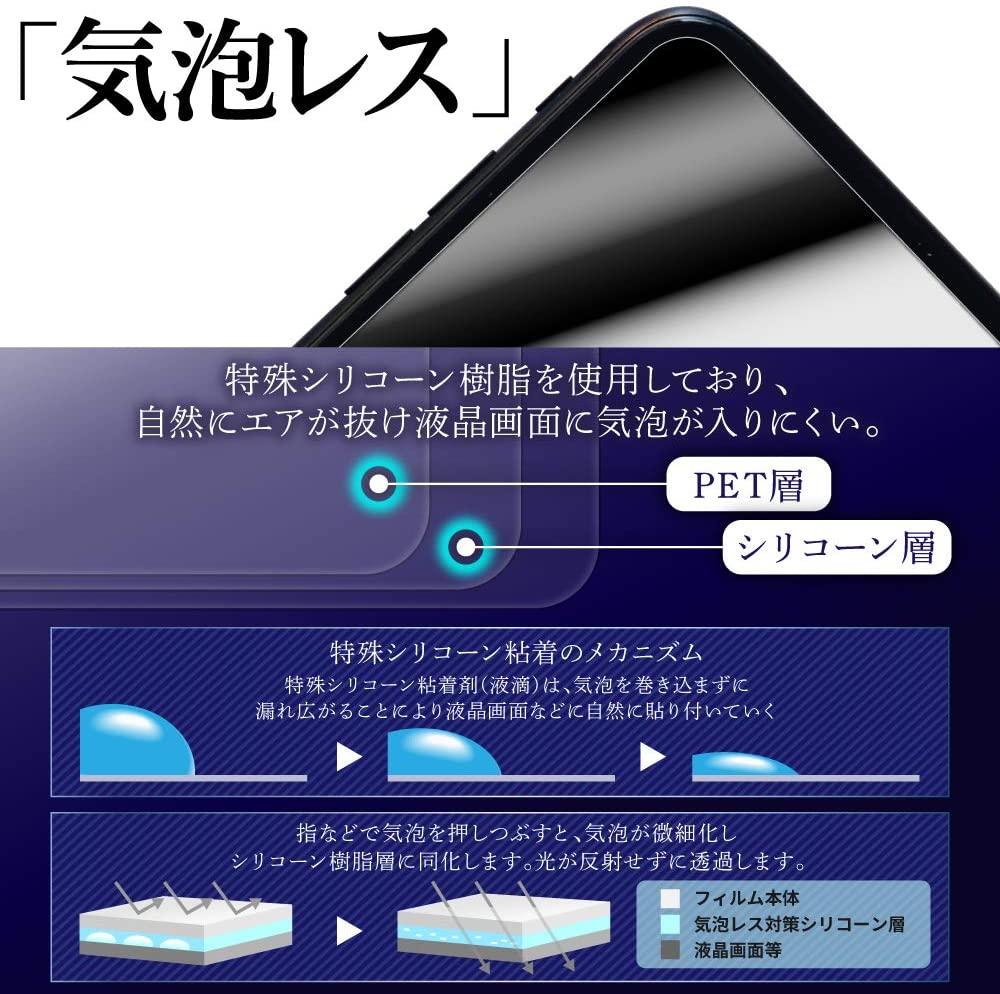

・★貼り直しOK---特殊シリコ-ン粘着剤を使用しているので、貼りなおす事が可能です。

・フィルムサイズ:17.3インチ専用サイズ(L)、対応型番:81LL003UJP

【サイズ】

高さ : 0.40 cm

横幅 : 26.00 cm

奥行 : 38.00 cm

重量 : 110.0 g

※梱包時のサイズとなります。商品自体のサイズではございませんのでご注意ください。Amazon.co.jp: 【2枚セット】Lenovo IdeaPad L340 Gaming 17.3インチ

Amazon.co.jp: 【2枚セット】Lenovo IdeaPad L340 Gaming 17.3

Amazon.co.jp: 【2枚セット】Lenovo IdeaPad L340 Gaming 17.3インチ

Amazon.co.jp: 【2枚セット】Lenovo IdeaPad L340 Gaming 17.3インチ

IdeaPad L340 Gaming 17.3インチ 2019年モデル 用 N40L 4wayのぞき見

楽天市場】【2枚セット】Lenovo Ideapad L340 Gaming 17.3インチ 2019

Lenovo (レノボ) 2019 Ideapad L340 ゲーミングノートパソコン 15.6インチ FHD IPSディスプレイ 第9世代 Intel クアッドコア i5-9300H 最大4.1GHz 16GB DDR4 RAM 512GB SSD NVIDIA GeForce GTX 1650

楽天市場】【2枚セット】Lenovo Ideapad L340 Gaming 17.3インチ 2019

Lenovo IdeaPad L340 ゲーミングエディション |パワー圧巻、スタイル

Lenovo IdeaPad L340 Gaming Laptop | 17-inch Laptop with Intel®

Lenovo IdeaPad L340 ゲーミングエディション |パワー圧巻、スタイル

Lenovo IdeaPad L340 ゲーミングエディション |パワー圧巻、スタイル

Lenovo IdeaPad L340 ゲーミングエディション |パワー圧巻、スタイル

IdeaPad L340 (AMD) | 15.6 型ノートパソコン | レノボ・ ジャパン

Amazon.co.jp: LOE(ロエ) 14インチ (3:2) ノートパソコン 保護

12.1インチ 16:9 覗き見防止フィルム ノートパソコン プライバシーフィルター PC 液晶保護フィルム 両面使用可能 ブルーライトカット 反射防止 着脱簡単 パナソニック CF-NX4、CF-SX2 HLEPMATE

楽天市場】Lenovo Ideapad L340 Gaming 17.3インチ 2019年モデル 用

Lenovo IdeaPad L340 ゲーミングエディション |パワー圧巻、スタイル

Amazon.co.jp: 【2枚セット】Lenovo IdeaPad L340 Gaming 15.6インチ

12.1インチ 16:9 覗き見防止フィルム ノートパソコン プライバシーフィルター PC 液晶保護フィルム 両面使用可能 ブルーライトカット 反射防止 着脱簡単 パナソニック CF-NX4、CF-SX2 HLEPMATE

Lenovo (レノボ) 2019 Ideapad L340 ゲーミングノートパソコン 15.6インチ FHD IPSディスプレイ 第9世代 Intel クアッドコア i5-9300H 最大4.1GHz 16GB DDR4 RAM 512GB SSD NVIDIA GeForce GTX 1650

12.1インチ 16:9 覗き見防止フィルム ノートパソコン プライバシーフィルター PC 液晶保護フィルム 両面使用可能 ブルーライトカット 反射防止 着脱簡単 パナソニック CF-NX4、CF-SX2 HLEPMATE

12.1インチ 16:9 覗き見防止フィルム ノートパソコン プライバシーフィルター PC 液晶保護フィルム 両面使用可能 ブルーライトカット 反射防止 着脱簡単 パナソニック CF-NX4、CF-SX2 HLEPMATE

Lenovo IdeaPad L340 ゲーミングエディション |パワー圧巻、スタイル

Amazon.co.jp: エレコム プライバシーフィルター Surface Laptop 5 / 4

88IPG301700

Amazon.co.jp: LOE(ロエ) 14インチ (3:2) ノートパソコン 保護フィルム

Lenovo ThinkPad L14 Gen 3 AMD 14インチ 16:9 のぞき見防止 フィルター プライバシーフィルター パソコンPC ノートブック型 液晶保護フィルム ブルーライトカット 反射防止 パソコン セキュリティー覗き見防止 両面使用可能 反射防止 着脱簡単

楽天市場】【Norton1】【2/29-3/2限定】P10倍!新生活 直販 ノート

Lenovo IdeaPad L340 ゲーミングエディション |パワー圧巻、スタイル

12.1インチ 16:9 覗き見防止フィルム ノートパソコン プライバシーフィルター PC 液晶保護フィルム 両面使用可能 ブルーライトカット 反射防止 着脱簡単 パナソニック CF-NX4、CF-SX2 HLEPMATE

Lenovo IdeaPad L340-15API CPU:Ryzen 3 3200U 2.6GHz / メモリ:8GB

Lenovo IdeaPad L340 ゲーミングエディション |パワー圧巻、スタイル

製品の概要- IdeaPad L340-15API, L340-17API, L340-15API Touch

Amazon.co.jp: LOE(ロエ) 14インチ (3:2) ノートパソコン 保護フィルム

エレコム プライバシーフィルター Surface Laptop 5 / 4 / 3 / 2 / 1 のぞき見防止 フィルタ 13.5インチ ナノサクション ブルーライトカット アンチグレア 紫外線カット EF-MSL4PFNS2

脱着型2in1 Lenovo IdeaPad D330 中古 WPS Office搭載 Windows11 4GB

Lenovo IdeaPad Gaming 370 - オニキスグレー- マイクロソフトオフィス

Lenovo (レノボ) 2019 Ideapad L340 ゲーミングノートパソコン 15.6インチ FHD IPSディスプレイ 第9世代 Intel クアッドコア i5-9300H 最大4.1GHz 16GB DDR4 RAM 512GB SSD NVIDIA GeForce GTX 1650

Amazon.co.jp: LOE(ロエ) 14インチ (3:2) ノートパソコン 保護フィルム

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています