車中泊マット FIELDOOR 5cm厚 Sサイズ/カーキ 2個セット 自動膨張マットレス 連結可能 高密度ウレタンフォーム 大型バルブ エ

(税込) 送料込み

商品の説明

商品情報

【カテゴリー】

9165円車中泊マット FIELDOOR 5cm厚 Sサイズ/カーキ 2個セット 自動膨張マットレス 連結可能 高密度ウレタンフォーム 大型バルブ エアウトドア、釣り、旅行用品アウトドア、キャンプ、登山車中泊マット FIELDOOR 枕付き 5cm厚 2個セット Lサイズ ブラウン 自動

エアーマットレス、エアーベッド

【商品名】

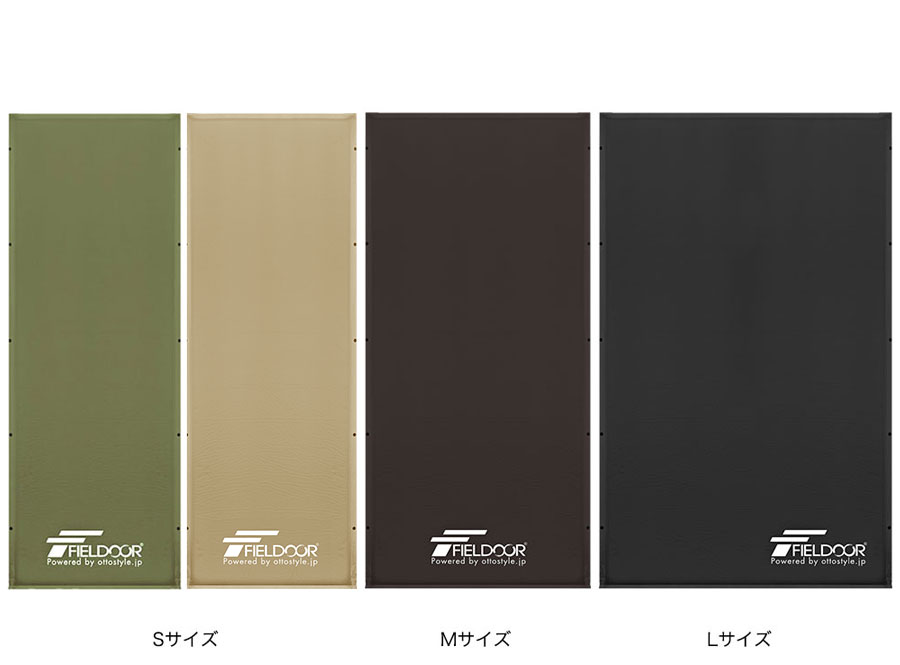

FIELDOOR 車中泊マット 5cm厚 Sサイズ/カーキ 2個セット 自動膨張マットレス 連結可能 高密度ウレタンフォーム 大型バルブ エ

【ブランド】

FIELDOOR(フィールドア)

【商品説明】

・※商品は、モニターによって色合いが異なって見える場合があります。 ※仕様・デザインは改良のため予告なく変更することがあります。

・サイズ 本体サイズ : (約)65cm×190cm×5cm ※収納時 : (約)φ20cm×67cm ウレタンサイズ : (約)59cm×184cm×5cm

・材質 ポリエステル / 高密度ウレタンフォーム

・重量 (約)1.9kg

【サイズ】

高さ : 16.00 cm

横幅 : 32.00 cm

奥行 : 66.00 cm

重量 : 3.80 kg

※梱包時のサイズとなります。商品自体のサイズではございませんのでご注意ください。Amazon | FIELDOOR 車中泊マット 5cm厚 【Sサイズ/カーキ】 2個セット

FIELDOOR 枕付き 車中泊マット 5㎝厚 自動膨張マットレス 連結可能 高密度ウレタンフォーム 大型バルブ エアーマット インフレータブル キャンプ アウトドア

Amazon | FIELDOOR 車中泊マット 5cm厚 【Sサイズ/カーキ】 2個セット

Amazon | FIELDOOR 車中泊マット 5cm厚 【Sサイズ/カーキ】 2個セット

FIELDOOR 枕付き 車中泊マット 5㎝厚 自動膨張マットレス 連結可能 高密度ウレタンフォーム 大型バルブ エアーマット インフレータブル キャンプ アウトドア

FIELDOOR 車中泊マット 10cm厚 Sサイズ/カーキ 自動膨張マットレス

FIELDOOR 車中泊マット 10cm厚 Sサイズ/カーキ 自動膨張マットレス

FIELDOOR 車中泊マット 10cm厚 Sサイズ/カーキ 自動膨張マットレス

FIELDOOR 車中泊マット 10cm厚 Sサイズ 自動膨張マットレス 連結

Amazon | FIELDOOR 車中泊マット 10cm厚 【Mサイズ/ブラウン】 2個

Amazon | FIELDOOR 車中泊マット 5cm厚 【Mサイズ/ブラウン】 2個

FIELDOOR 車中泊マット 10cm厚 【Lサイズ/ブラウン】 自動膨張マットレス 連結可能 高密度ウレタンフォーム 大型バルブ エアーマット インフレータブル キャンプ アウトドア

FIELDOOR 車中泊マット 10cm厚 Sサイズ/カーキ 自動膨張マットレス

車中泊マット FIELDOOR 枕付き 5cm厚 2個セット Lサイズ ブラウン 自動

Amazon.co.jp: FIELDOOR 車中泊マット 5cm厚 【Lサイズ/ブラック】 2個

車中泊マット FIELDOOR 枕付き 5cm厚 2個セット Lサイズ ブラウン 自動

Amazon | FIELDOOR 車中泊マット 10cm厚 【Sサイズ/オレンジ

FIELDOOR(フィールドア) | 枕付き車中泊マット

FIELDOOR 車中泊マット 10cm厚 Sサイズ/カーキ 自動膨張マットレス

車中泊マット FIELDOOR 枕付き 5cm厚 2個セット Lサイズ ブラウン 自動

FIELDOOR 枕付き 車中泊マット 5㎝厚 自動膨張マットレス 連結可能 高密度ウレタンフォーム 大型バルブ エアーマット インフレータブル キャンプ アウトドア

車中泊マット FIELDOOR 枕付き 5cm厚 2個セット Lサイズ ブラウン 自動

fieldoor 車中泊マットの人気商品・通販・価格比較 - 価格.com

Amazon | FIELDOOR 車中泊マット 5cm厚 【Mサイズ/ブラウン】 2個

楽天市場】車中泊 マット 厚さ 5cm Sサイズ 幅65cm 収納袋付

FIELDOOR 枕付き 車中泊マット 5㎝厚 自動膨張マットレス 連結可能 高密度ウレタンフォーム 大型バルブ エアーマット インフレータブル キャンプ アウトドア

車中泊マット FIELDOOR 枕付き 5cm厚 2個セット Lサイズ ブラウン 自動

FIELDOOR 車中泊マット 10cm厚 Sサイズ/カーキ 自動膨張マットレス

FIELDOOR 車中泊マット 5cm厚 【Lサイズ/ブラック】 2個セット 自動膨張マットレス 連結可能 高密度ウレタンフォーム 大型バルブ エアーマット インフレータブル キャンプ アウトドア

Amazon | FIELDOOR 車中泊マット 5cm厚 【Mサイズ/ブラウン】 2個

FIELDOOR 枕付き 車中泊マット 5㎝厚 自動膨張マットレス 連結可能 高密度ウレタンフォーム 大型バルブ エアーマット インフレータブル キャンプ アウトドア

楽天市場】車中泊 マット 厚さ 5cm Sサイズ 幅65cm 収納袋付

FIELDOOR 車中泊マット 5cm厚 Mサイズ 自動膨張マットレス 連結可能 高密度ウレタンフォーム 大型バルブ エアーマット インフレータブル キャンプ アウトドア

fieldoor 車中泊マットの人気商品・通販・価格比較 - 価格.com

FIELDOOR 枕付き 車中泊マット 5㎝厚 自動膨張マットレス 連結可能 高密度ウレタンフォーム 大型バルブ エアーマット インフレータブル キャンプ アウトドア

fieldoor 車中泊マットの人気商品・通販・価格比較 - 価格.com

楽天市場】【楽天1位】車中泊 マット 厚さ 5cm Mサイズ 幅93cm 収納袋

FIELDOOR(フィールドア) | 車中泊マット

車中泊マット FIELDOOR 枕付き 5cm厚 2個セット Lサイズ ブラウン 自動

楽天市場】【楽天1位】車中泊 マット 厚さ 5cm Mサイズ 幅93cm 収納袋

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています