ふるさと納税 【匠の技】菓子工房 ひのでや てづくり ショコラ 25個 詰め合わせセット【シェフのこだわりと技術が詰まったチョコレート】 D-175 佐賀県鹿島市

(税込) 送料込み

商品の説明

商品情報

■ 容量

13200円ふるさと納税 【匠の技】菓子工房 ひのでや てづくり ショコラ 25個 詰め合わせセット【シェフのこだわりと技術が詰まったチョコレート】 D-175 佐賀県鹿島市食品スイーツ、洋菓子ホワイトデー対応可【匠の技】菓子工房 ひのでや てづくり ショコラ 15

てづくり ショコラ 25個

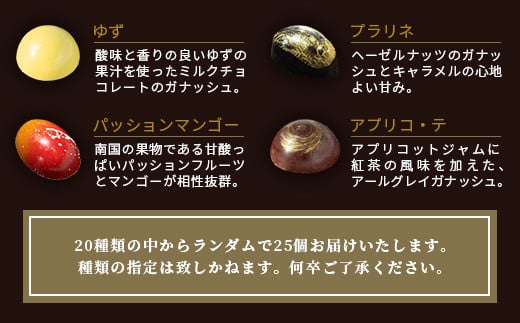

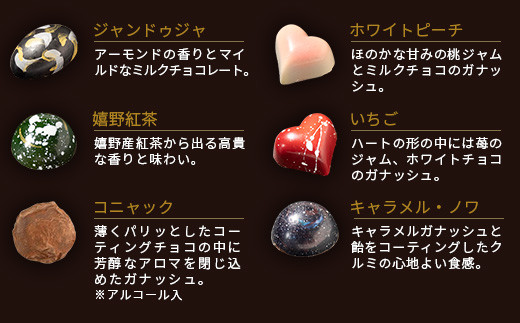

※ショコラの種類はシェフのおまかせとなります。ご指定はいただけません。ご了承ください。

■賞味期限■

発送日を含め2週間(要冷蔵)

■ 配送について

ご入金確認後、30日以内に発送いたします

タイプ:【冷蔵】【ギフト】ホワイトデー対応可【匠の技】菓子工房 ひのでや てづくり ショコラ 25

楽天市場】【ふるさと納税】【匠の技】菓子工房 ひのでや てづくり

匠の技】菓子工房 ひのでや てづくり ショコラ 25個 詰め合わせセット

【楽天市場】【ふるさと納税】【匠の技】菓子工房 ひのでや て

楽天市場】【ふるさと納税】【匠の技】菓子工房 ひのでや てづくり

ホワイトデー対応可【匠の技】菓子工房 ひのでや てづくり ショコラ 25個 詰め合わせセット【シェフのこだわりと技術が詰まったチョコレート】 D-175 バレンタインデー ホワイトデー 本命 義理チョコ チョコ

【匠の技】菓子工房 ひのでや てづくり ショコラ 25個 詰め合わせセット【シェフのこだわりと技術が詰まったチョコレート】 D-175

【匠の技】菓子工房 ひのでや てづくり ショコラ 25個 詰め合わせセット【シェフのこだわりと技術が詰まったチョコレート】 D-175

【匠の技】菓子工房 ひのでや てづくり ショコラ 25個 詰め合わせセット【シェフのこだわりと技術が詰まったチョコレート】 D-175

楽天市場】【ふるさと納税】【匠の技】菓子工房 ひのでや てづくり

【匠の技】菓子工房 ひのでや てづくり ショコラ 25個 詰め合わせセット【シェフのこだわりと技術が詰まったチョコレート】 D-175

ふるさと納税 【匠の技】菓子工房 ひのでや てづくり ショコラ 25個

ふるさと納税 【匠の技】菓子工房 ひのでや てづくり ショコラ 25個

ホワイトデー対応可【匠の技】菓子工房 ひのでや てづくり ショコラ 15

ホワイトデー対応可【匠の技】菓子工房 ひのでや てづくり ショコラ 15個 詰め合わせセット【シェフのこだわりと技術が詰まったチョコレート】 B-562 バレンタインデー ホワイトデー 本命 義理チョコ チョコ

ホワイトデー対応可【匠の技】菓子工房 ひのでや てづくり ショコラ 15

ふるさと納税 【匠の技】菓子工房 ひのでや てづくり ショコラ 25個

ホワイトデー対応可【匠の技】菓子工房 ひのでや てづくり ショコラ 15

ホワイトデー対応可【匠の技】菓子工房 ひのでや てづくり ショコラ 15

ホワイトデー対応可【匠の技】菓子工房 ひのでや てづくり ショコラ 15

ホワイトデー対応可【匠の技】菓子工房 ひのでや てづくり ショコラ 15

【楽天市場】【ふるさと納税】 マカロン15個【詰め合わせ】菓子

ふるさと納税 【匠の技】菓子工房 ひのでや てづくり ショコラ 25個

ホワイトデー対応可【匠の技】菓子工房 ひのでや てづくり ショコラ 15

菓子・スイーツ | ふるさと納税の返礼品一覧(21サイト横断・人気順

菓子のお礼の品 | Tふるさと納税

ホワイトデー対応可【匠の技】菓子工房 ひのでや てづくり ショコラ 15

ホワイトデー対応可【匠の技】菓子工房 ひのでや てづくり ショコラ 15

楽天市場】【ふるさと納税】【匠の技】菓子工房 ひのでや てづくり

ふるさと納税 「シェフ自慢の【焼き菓子】とドーナツの【アソート

ホワイトデー対応可【匠の技】菓子工房 ひのでや てづくり ショコラ

検索結果 | Tふるさと納税

楽天市場】【ふるさと納税】【匠の技】菓子工房 ひのでや てづくり

ANAのふるさと納税 | おすすめ チョコの返礼品のご紹介

ホワイトデー対応可【匠の技】菓子工房 ひのでや てづくり ショコラ 15

検索結果 | Tふるさと納税

ふるさと納税 佐賀県 鹿島市 【匠の技】菓子工房 ひのでや てづくり

ふるさと納税 「マカロン15個【詰め合わせ】菓子工房【ひのでや

楽天市場】【ふるさと納税】 マカロン15個【詰め合わせ】菓子工房

菓子・スイーツ | ふるさと納税の返礼品一覧(21サイト横断・人気順

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています