ハネウェル HD 2Pts ハーネス L/XL ハネウェル FPSEAEH10001LXL 保護具 墜落 落下防止用品 ハーネス型墜落制止用器具 代引不可

(税込) 送料込み

商品の説明

商品情報

【商品スペック】

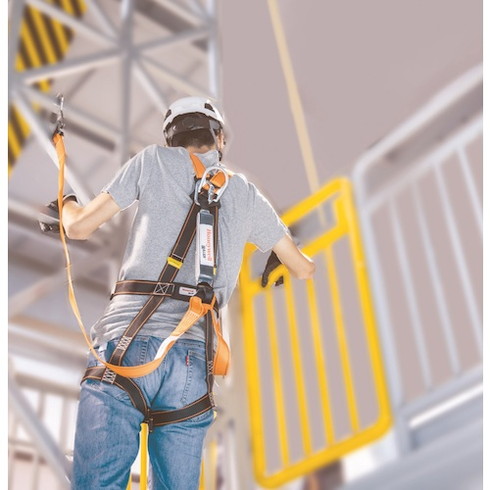

10380円ハネウェル HD 2Pts ハーネス L/XL ハネウェル FPSEAEH10001LXL 保護具 墜落 落下防止用品 ハーネス型墜落制止用器具 代引不可DIY、工具業務、産業用墜落制止用器具|HD 2Ptsハーネス | 日本ハネウェル - Powered by イプロス

特長

●胸部と背部の2箇所にD環を備えているため、作業環境・内容に応じた柔軟な使い分けや救助用として使用できます。●はしご昇降や閉鎖空間内作業に有用な胸部D環を備えています。●明瞭な蛍光オレンジのベルトと縫糸のため、点検が容易です。●容易な点検をサポートするフォールインジケータを備えています。

用途

●建設、工場、プラント、鉱山、橋梁、造船、土木、その他

仕様

●サイズ:L/XL●色:オレンジ・黒●腿バックル:パススルー●ベルト幅(mm):40

仕様2

●規格:厚生労働省「墜落制止用器具の規格」適合品 ●CE 認証(EN361)適合 ●水平股ベルトタイプ ●背面および前面 D 環●最大使用質量100kg

材質/仕上

●肩・胸・股ベルト:ポリエステル●各部バックル連結調整具及びD環:鋼材

セット内容/付属品

注意ハネウェル HD 2Pts ハーネス L/XL ハネウェル FPSEAEH10001LXL 保護具 墜落 落下防止用品 ハーネス型墜落制止用器具(代引不可)【送料無料】 | リコメン堂生活館

楽天市場】ハネウェル HD 2Pts ハーネス L/XL ハネウェル

楽天市場】ハネウェル HD 2Pts ハーネス L/XL ハネウェル

楽天市場】ハネウェル HD 2Pts ハーネス L/XL ハネウェル

墜落制止用器具|HD 2Ptsハーネス | 日本ハネウェル - Powered by イプロス

FPSEAEH10001L/XL フルハーネス型墜落制止用器具 HD 2Pts ハーネス 1本

FPSEAEH10001L/XL フルハーネス型墜落制止用器具 HD 2Pts ハーネス 1本

墜落制止用器具|HD 2Ptsハーネス | 日本ハネウェル - Powered by イプロス

Amazon.co.jp: HONEYWELL ハネウェル 新規格適合 第二種 墜落制止用

Amazon.co.jp: HONEYWELL ハネウェル 新規格適合 第二種 墜落制止用

墜落制止用器具|HDランヤードシリーズ (SL/DL) | 日本ハネウェル

墜落制止用器具|フルハーネス型 墜落制止用器具 | 日本ハネウェル

日本ハネウェル】人間工学に基づいたH型ハーネスを発売 - サイン

フルハーネス安全帯の通販|TOBI-HA.WK.トビホーク | 【新規格

楽天市場】ハネウェル HD 2Pts ハーネス L/XL ハネウェル

Amazon.co.jp: HONEYWELL ハネウェル 新規格適合 第二種 墜落制止用

フルハーネス安全帯の通販|TOBI-HA.WK.トビホーク | Honeywel

Amazon.co.jp: HONEYWELL ハネウェル 新規格適合 第二種 墜落制止用

タイプ2(第2種)のランヤードをお探しならハネウェルがおすすめ

Amazon.co.jp: HONEYWELL ハネウェル 新規格適合 第二種 墜落制止用

ハネウェル HD 2Pts ハーネス L/XL ハネウェル FPSEAEH10001LXL 保護具

Amazon.co.jp: HONEYWELL ハネウェル 新規格適合 第二種 墜落制止用

スタンダードフルハーネスAirCore|製品検索|製品情報|電材部品の

フルハーネス安全帯の通販|TOBI-HA.WK.トビホーク | 【新規格

墜落制止用器具|HDランヤードシリーズ (SL/DL) | 日本ハネウェル

フルハーネス安全帯の通販|TOBI-HA.WK.トビホーク | 【新規格

墜落制止用器具|HD 2Ptsハーネス | 日本ハネウェル - Powered by イプロス

Amazon.co.jp: HONEYWELL ハネウェル 新規格適合 第二種 墜落制止用

ハネウェル HD 2Pts ハーネス L/XL FPSEAEH10001L/XL 1本 257-1460

ハネウェル HD 2Pts ハーネス L/XL ハネウェル FPSEAEH10001LXL 保護具

ハネウェル 8927/8INGN フルハーネス用 Oリングエクステンション

タイプ2(第2種)のランヤードをお探しならハネウェルがおすすめ

ハネウェル ワークプレイス ハーネス 通販 | カナマル産業株式会社

SALE価格で通販中】 ハネウェル HD 2Pts ハーネス L/XL ハネウェル

ハネウェル ワークプレイス ハーネス 通販 | カナマル産業株式会社

墜落制止用器具|HD 2Ptsハーネス | 日本ハネウェル - Powered by イプロス

ハネウェル HD 2Pts ハーネス L/XL FPSEAEH10001L/XL 1本 257-1460

フルハーネス安全帯の通販|TOBI-HA.WK.トビホーク | 【新規格

ハネウェル 墜落制止用巻き取り式ランヤード 小型SRL(第2種) 【受注停止】 FP81ST1.8R

楽天市場】No.FGH-16WM-GY No.FGH-16WL-GY 新規格 墜落制止用器具 TOYO

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています