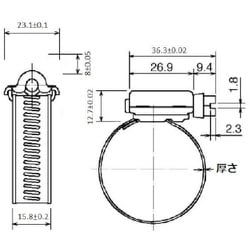

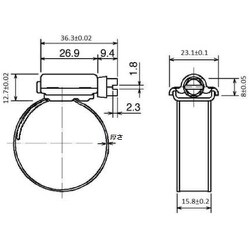

TRUSCO トラスコ中山 ホースバンド15.8×Φ232mm [TA16-232] TA16232 販売単位:1 送料無料

(税込) 送料込み

商品の説明

商品情報

園芸用品 ホース・散水用品 ホースバンド ●オールステンレスを採用しているため、耐腐食性が高いです。●管材、建機関連。●最大径(mm):232●最小径(mm):210●バンド幅(mm):15.8●厚さ(mm):0.7●締付トルク(N・m):24●6角ボルト(mm):8●スクリュー・バンド・ハウジング:ステンレス(SUS304)●バンド・ハウジング:ステンレス(SUS304)

6671円TRUSCO トラスコ中山 ホースバンド15.8×Φ232mm [TA16-232] TA16232 販売単位:1 送料無料DIY、工具庭、ガーデニングトラスコ中山 ハンドリフター150kg400X720オレンジヨドバシ.com - トラスコ中山 TRUSCO TA16-232 [TRUSCO ホースバンド

楽天市場】TRUSCO ホースバンド15.8×Φ232mm TE16232 トラスコ中山

ヨドバシ.com - トラスコ中山 TRUSCO TA16-232 [TRUSCO ホースバンド

トラスコ中山 TRUSCO ホースバンド オールSUS 普及 10個入 8×Φ16mm TA8

ヨドバシ.com - トラスコ中山 TRUSCO TE16-232 [TRUSCO ホースバンド

トラスコ中山 TRUSCO ホースバンド オールSUS 普及 10個入 12.7×Φ22mm

楽天市場】TRUSCO ホースバンド15.8×Φ232mm TE16232 トラスコ中山

TRUSCO ホースバンド オールSUS 普及 10個入 8×Φ16mm TA8-16 [818-6891]

トラスコ中山 TRUSCO 自在手締めホースバンド 20~44mm TH-2044 1箱(10

TRUSCO ホースバンド オールSUS 普及 10個入 8×Φ16mm TA8-16 [818-6891]

人気アイテム タンガロイ 旋削加工用インサート PVDコーティング

TRUSCO トラスコ中山株式会社

TRUSCO ホースバンド オールSUS 普及 10個入 8×Φ16mm TA8-16 [818-6891]

TRUSCO トラスコ中山株式会社

トラスコ中山 TRUSCO ステンレス製ピンセット 150mm 直ギザ付 TSP23 1

TRUSCO トラスコ中山株式会社

TRUSCO ホースバンド オールSUS 普及 10個入 8×Φ16mm TA8-16 [818-6891]

トラスコ中山 TRUSCO 小判J型フック SUS 黒 62mm SH-62-BK 1個 206

商品カタログ(紙&Web)|TRUSCO トラスコ中山株式会社

TRUSCOのホースバンド 【通販モノタロウ】 コンプレッサー・空圧機器

トラスコ中山 TRUSCO ホースバンド オールSUS 普及 10個入 8×Φ16mm TA8

TRUSCO ホースバンド オールSUS 普及 10個入 8×Φ16mm TA8-16 [818-6891]

トラスコ中山 TRUSCO ダブルクリップ 小 19mm(10個入) TDB-19 1袋(10個

TRUSCO トラスコ中山株式会社

TRUSCOのホースバンド 【通販モノタロウ】 コンプレッサー・空圧機器

Amazon | トラスコ中山(TRUSCO) タイヤゲージ ガンタイプ 1400kPa 米式

トラスコ中山 ハンドリフター150kg400X720オレンジ

トラスコ中山 TRUSCO ステンレス製ピンセット 150mm 直ギザ付 TSP23 1

TRUSCO トラスコ中山株式会社

TRUSCO トラスコ中山株式会社

TRUSCO ホースバンド オールSUS 普及 10個入 8×Φ16mm TA8-16 [818-6891

TRUSCOのホースバンド 【通販モノタロウ】 コンプレッサー・空圧機器

TRUSCO トラスコ中山株式会社

トラスコ中山 TRUSCO ツイスターホース50M クロ THRG-50 1巻 123-1263(直送品)

Amazon.co.jp: トラスコ中山(TRUSCO) αウレタンブレードホース 8.5X12

商品カタログ(紙&Web)|TRUSCO トラスコ中山株式会社

TRUSCO ホースバンド オールSUS 普及 10個入 8×Φ16mm TA8-16 [818-6891

TRUSCOのホースバンド 【通販モノタロウ】 コンプレッサー・空圧機器

TRUSCO トラスコ中山 マジックバンド 超薄型 ストラップ 幅19mm×長さ

TRUSCO トラスコ中山株式会社

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています

![TRUSCO ホースバンド オールSUS 普及 10個入 8×Φ16mm TA8-16 [818-6891]](https://www.santec-wel.jp/data/yousetsuyouhin/product/8186891_2.jpg)

![TRUSCO ホースバンド オールSUS 普及 10個入 8×Φ16mm TA8-16 [818-6891]](https://www.santec-wel.jp/data/yousetsuyouhin/product/8186891_3.jpg)