ベッド セミダブル 国産ポケットコイルマットレス付き グレージュ 収納付き 宮付 棚付 コンセント付

(税込) 送料込み

商品の説明

商品情報

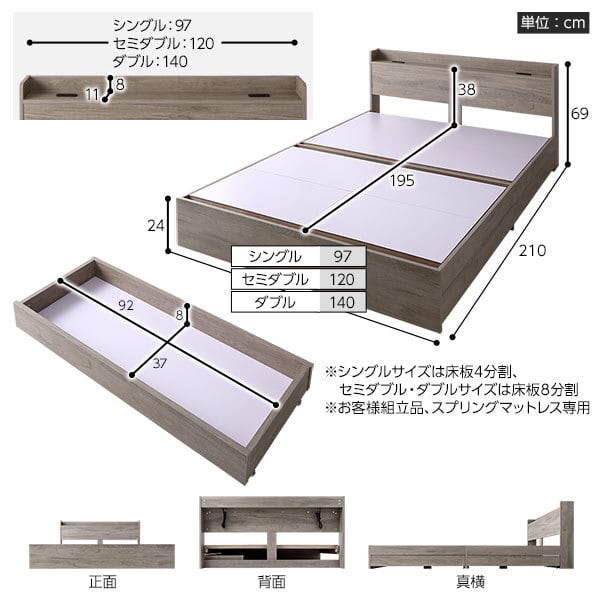

【商品名】 ベッド セミダブル 国産ポケットコイルマットレス付き グレージュ 収納付き 宮付 棚付 コンセント付 【ジャンル・特徴】 収納付きベッド 収納ベット 引き出し収納付きベッド 宮棚付き スマホスタンド付き 引っ越し 引越し ひっこし 1人暮らし ひとりぐらし 新生活 ファミリー 店舗 施設 しゅうのうべっど しゅうのうべっと せみだぶるべっど せみだぶるべっと セミダブルベット SDベッド

80374円ベッド セミダブル 国産ポケットコイルマットレス付き グレージュ 収納付き 宮付 棚付 コンセント付家具、インテリアベッド、マットレスベッド シングル 国産ポケットコイルマットレス付き ブラウン 低床楽天市場】ベッド セミダブル 国産ポケットコイルマットレス付き

楽天市場】ベッド セミダブル 国産ポケットコイルマットレス付き

楽天市場】ベッド セミダブル 国産ポケットコイルマットレス付き

楽天市場】【ポイント4倍!水曜定休Pアップ 3/28 09:59まで

ベッド ダブル ボンネルコイルマットレス付き グレージュ 収納付き

ベッド ローベッド ダブル ポケットコイルマットレス付き グレージュ

ベッド セミダブル ベッドフレームのみ グレージュ 照明付き 収納付き

ベッド セミダブル ポケットコイルマットレス付き グレージュ 収納付き

ベッド セミダブル ポケットコイルマットレス付き グレージュ 収納付き-

楽天市場】ベッド シングル グレージュ 国産ポケットコイルマットレス

ベッド セミダブル ボンネルコイルマットレス付き ストーングレー 低床

Amazon|ベッド シングル ポケットコイルマットレス付き ベッド

ベッド セミダブル ポケットコイルマットレス付き グレージュ 収納付き

ベッド セミダブル ベッドフレームのみ 照明付 収納付 棚付 宮付

ベッド シングル ポケットコイルマットレス付き グレージュ フラップ扉

ベッド セミダブル ポケットコイルマットレス付き グレージュ 収納付き

ベッド セミダブル ポケットコイルマットレス付き グレージュ 収納付き

ベッド セミダブル 2層ポケットコイルマットレス付き グレージュ 低床

ベッド シングル 2層ポケットコイルマットレス付き ストーングレー 低

ミニマルな-ベッド シングル 2層ポケッ•トコイルマットレス付き

楽天市場】ベッド ワイドキング 200(S+S) 国産ポケットコイル

dショッピング |ベッド セミシングル 2層ポケットコイルマットレス付き

ベッド セミダブル 2層ポケットコイルマットレス付き ホワイト 収納

Amazon|RASIK ベッド セミダブル ポケットコイルマットレス付き

ベッド 連結ベッド シングル ポケットコイルマットレス付き グレージュ

ベッド セミダブル 2層ポケットコイルマットレス付き グレージュ 低床

ベッド シングル 国産ポケットコイルマットレス付き ブラウン 低床

楽天市場】ベッド ダブル 国産ポケットコイルマットレス付き

ベッド シングル ベッドフレームのみ グレージュ 収納付き 引き出し

dショッピング |ベッド ダブル 国産ポケットコイルマットレス付き

ベッド セミダブル ベッドフレームのみ グレージュ 高さ調整可 棚付き

ベッド セミダブル ベッドフレームのみ ストーングレー 収納付き

ベッド セミダブル ポケットコイルマットレス付き グレージュ 収納付き

楽天市場】【クーポンで最大20%OFF】 ベッド ダブル 2層ポケット

ベッド セミダブル 2層ポケットコイルマットレス付き グレージュ 低床

ベッド セミダブル 2層ポケットコイルマットレス付き ホワイト 収納

Amazon|ベッド セミダブル ボンネルコイルマットレス付き ベッド

ベッド 連結ベッド シングル ポケットコイルマットレス付き グレージュ

ベッド セミダブル ポケットコイルマットレス付き グレージュ 収納付き

ベッド セミダブル ベッドフレームのみ ストーングレー 収納付き

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています