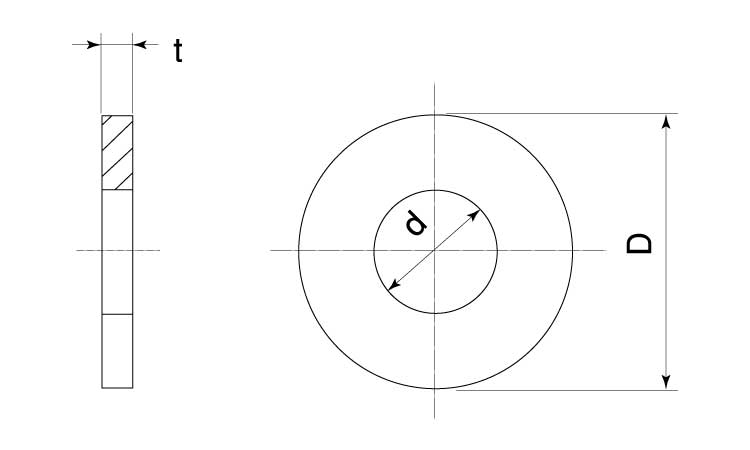

SUSマルW(6.5+0.3) 材質(ステンレス) 規格(6.5X17X1.5) 入数(1500) 【丸ワッシャー(特寸シリーズ】

(税込) 送料込み

商品の説明

商品説明

商品カテゴリ

- home life M-Proshop

- 螺子類

- 座金

- DIY、工具

- 材料、部品

- 金物、部品

- ワッシャー、座金

- 平ワッシャー、平座金

商品コード

03562005-001

楽天市場】丸ワッシャー(特寸【18個】SUSマルW(6.5+0.3) 6.5X15X1.5

丸ワッシャー(特寸【1500個】SUSマルW(6.5+0.3) 6.5X18X1.6

楽天市場】丸ワッシャー(特寸【18個】SUSマルW(6.5+0.3) 6.5X15X1.5

6.5×40×1.5 丸ワッシャー 特寸(ステンレス) 1パック(4個) 大阪魂

6.5×20×1.6 丸ワッシャー 特寸(ステンレス) 1パック(15個) 大阪魂

6.5×16×1.5 丸ワッシャー 特寸(ステンレス) 1パック(25個) 大阪魂

6.5×12×2.0 丸ワッシャー 特寸(ステンレス) 1パック(17個) 大阪魂

15×24×1.0 丸ワッシャー 特寸(ステンレス) 1パック(15個) 大阪魂

![Amazon | ステンレス/生地 丸ワッシャー [特寸] (公差: 1.05+0.1) 1.05](https://m.media-amazon.com/images/I/41Q mLMsZzL._AC_.jpg)

Amazon | ステンレス/生地 丸ワッシャー [特寸] (公差: 1.05+0.1) 1.05

4.5×15×1.0 丸ワッシャー 特寸(ステンレス) 1パック(25個) 大阪魂

SUSマルW(4.5+0.2) 材質(ステンレス) 規格(4.5X25X1.0) 入数(500) 【丸

6.5×30×2.0 丸ワッシャー 特寸(ステンレス)(小箱) 1箱(350個) 大阪魂

SUSマルW(4.5+0.2) 材質(ステンレス) 規格(4.5X25X1.0) 入数(500) 【丸

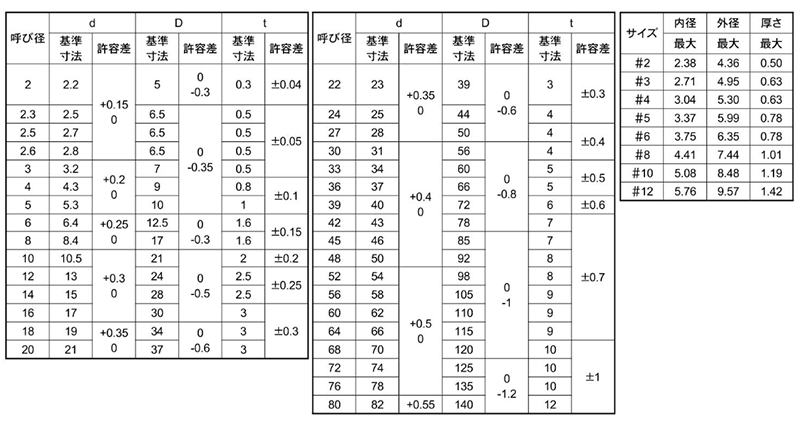

丸ワッシャー 特寸 ステンレス

![ステンレス/生地 丸ワッシャー [特寸] (公差: 1.05+0.1) 1.05×3×0.2 (10](https://m.media-amazon.com/images/I/51UTGFRV7rL._AC_UF894,1000_QL80_.jpg)

ステンレス/生地 丸ワッシャー [特寸] (公差: 1.05+0.1) 1.05×3×0.2 (10

丸ワッシャー ISO小形 ステンレス 表面処理なし

4.5×13×1.0 丸ワッシャー 特寸(ステンレス) 1パック(34個) 大阪魂

![Amazon | ステンレス/生地 丸ワッシャー [特寸] (公差: 1.05+0.1) 1.05](https://images-fe.ssl-images-amazon.com/images/I/61prFLEfTaL._AC_UL600_SR600,600_.jpg)

Amazon | ステンレス/生地 丸ワッシャー [特寸] (公差: 1.05+0.1) 1.05

![Amazon | ステンレス/生地 丸ワッシャー [特寸] (公差: 1.05+0.1) 1.05](https://images-fe.ssl-images-amazon.com/images/I/31EMpdZaDPL._AC_UL600_SR600,600_.jpg)

Amazon | ステンレス/生地 丸ワッシャー [特寸] (公差: 1.05+0.1) 1.05

5×10×1.0 丸ワッシャー ISO(ステンレス) 1パック(50個) 大阪魂 【通販

![Amazon | ステンレス/生地 丸ワッシャー [特寸] (公差: 1.05+0.1) 1.05](https://images-fe.ssl-images-amazon.com/images/I/51Bbvpy1nIL._AC_UL600_SR600,600_.jpg)

Amazon | ステンレス/生地 丸ワッシャー [特寸] (公差: 1.05+0.1) 1.05

10枚】ISO 小型丸ワッシャー SUS ステンレス M12×21×2.5t 10枚

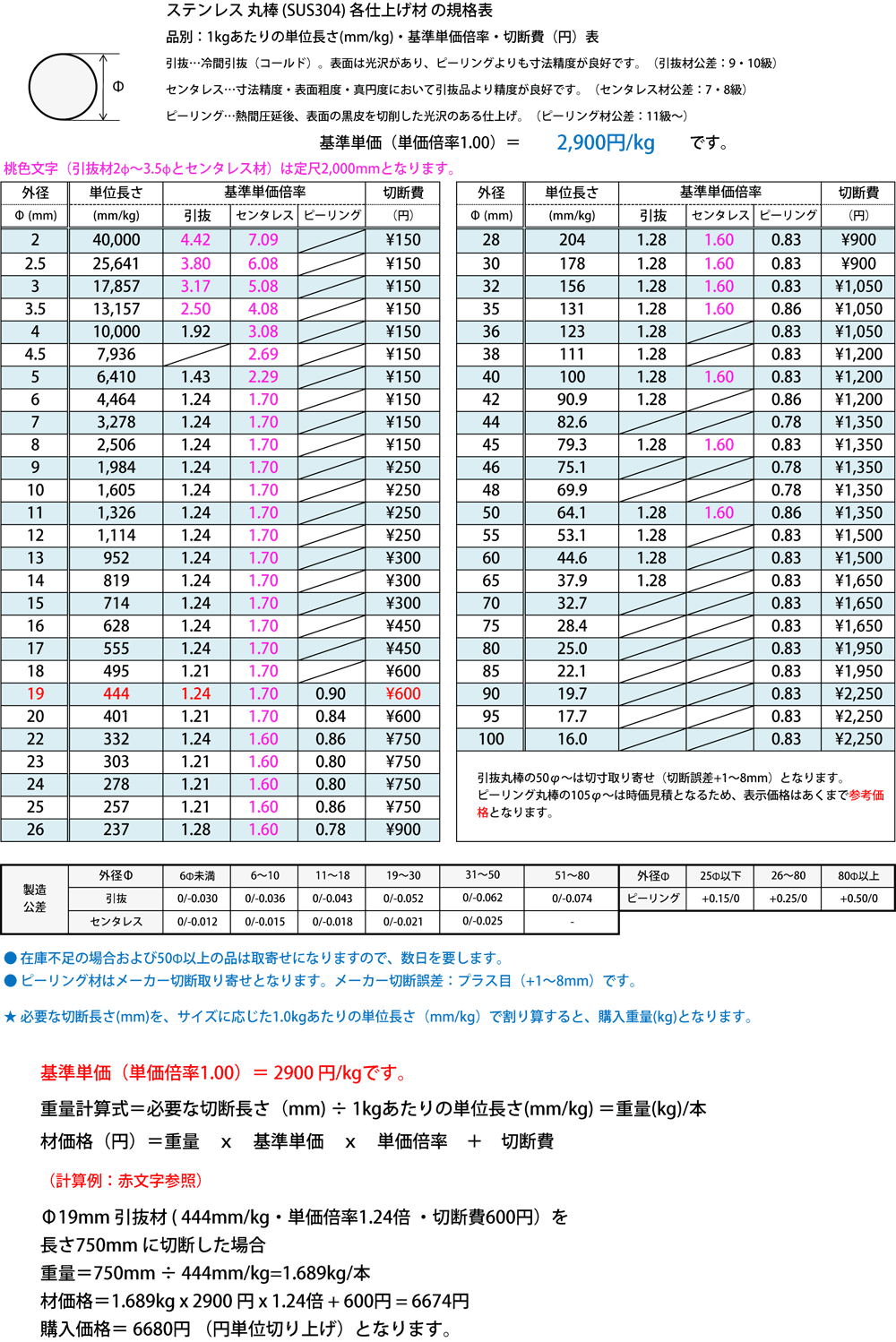

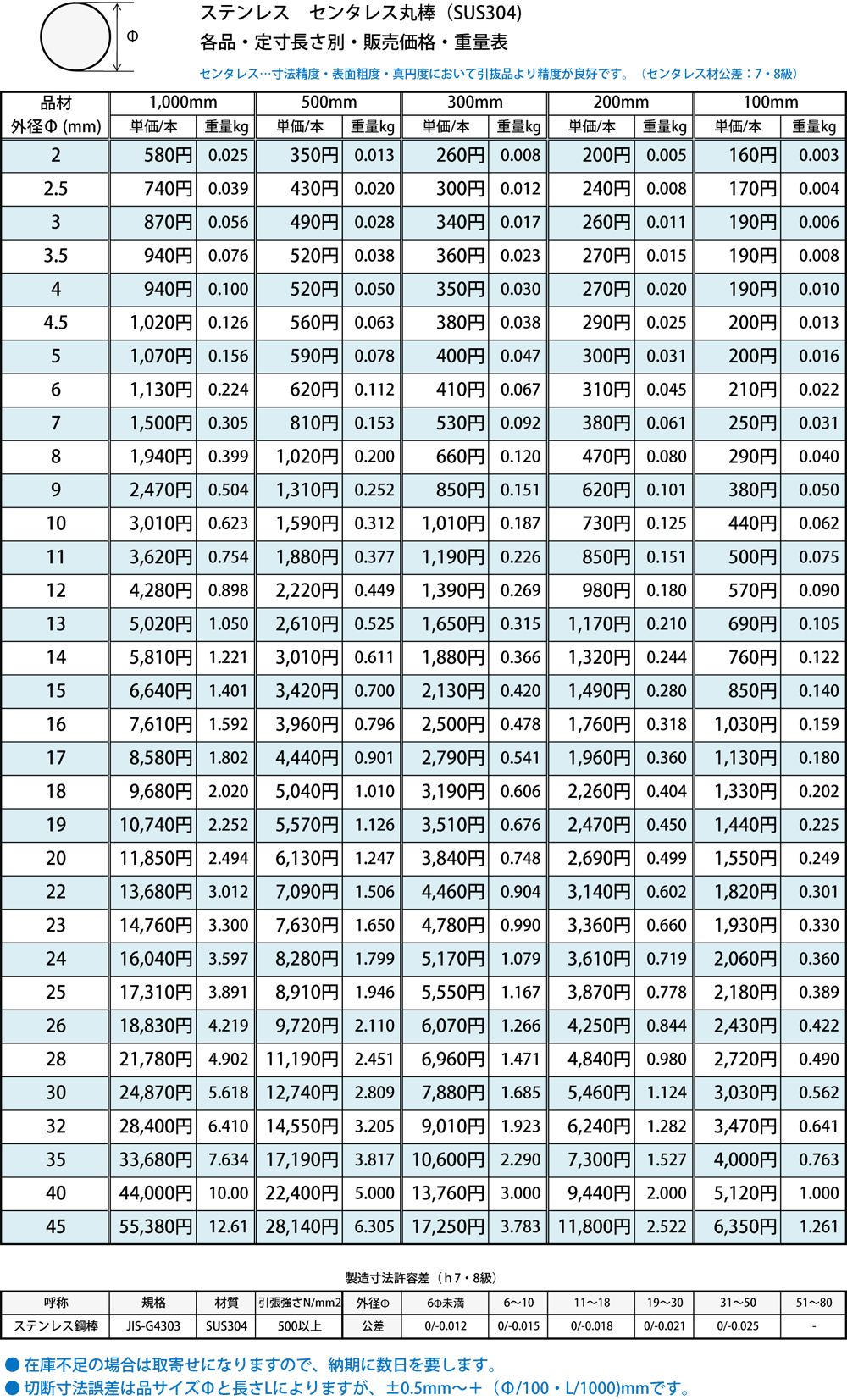

ステンレス 丸棒 丸鋼 シャフト 各種仕上材(SUS304) 切り売り 小口販売

ステンレス SUS316L(A4) 丸ワッシャー ISO

![Amazon | ステンレス/生地 丸ワッシャー [特寸] (公差: 1.05+0.1) 1.05](https://images-fe.ssl-images-amazon.com/images/I/51loWxZFE1L._AC_UL600_SR600,600_.jpg)

Amazon | ステンレス/生地 丸ワッシャー [特寸] (公差: 1.05+0.1) 1.05

ステンレス SUS310S (耐熱鋼) 丸ワッシャー ISO

ステンレス センタレス丸棒(SUS304) 各形状の(1000~100mm)各定寸長で

ステンレス 六角棒 (SUS304) 六角鋼 切り売り 小口販売加工 | 金属材料

ステンレス SUS316L(A4) 丸ワッシャー ISO

丸ワッシャー(特寸マルW(6.5 0.4) 6.5X17X2.3 標準(または鉄) 生地

WSX-SUS-M6SX20-1.5 | 丸ワッシャー 特寸 ステンレス | SUNCO

ステンレス SUS316L(A4) 丸ワッシャー ISO

丸ワッシャー(特寸マルW(6.5 0.4) 6.5X17X2.3 標準(または鉄) 生地

楽天市場】「S35E」 sus316 マルカン 直径3.5mm 線径0.6mm ステンレス

丸ワッシャー(特寸マルW(6.5 0.4) 6.5X17X2.3 標準(または鉄) 生地

丸ワッシャー(特寸マルW(6.5 0.4) 6.5X17X2.3 標準(または鉄) 生地

丸ワッシャー(特寸マルW(6.5 0.4) 6.5X17X2.3 標準(または鉄) 生地

丸ワッシャー(特寸マルW(6.5 0.4) 6.5X17X2.3 標準(または鉄) 生地

WSX-SUS-M10X40-2 | 丸ワッシャー 特寸 ステンレス | SUNCO

丸ワッシャー(特寸【3個】SUSマルW(10.5+0.3) 10.5X30X2 ステンレス

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています