GODOX Lux Junior クリップオンフラッシュ(KPI正規輸入品)

(税込) 送料込み

商品の説明

商品情報

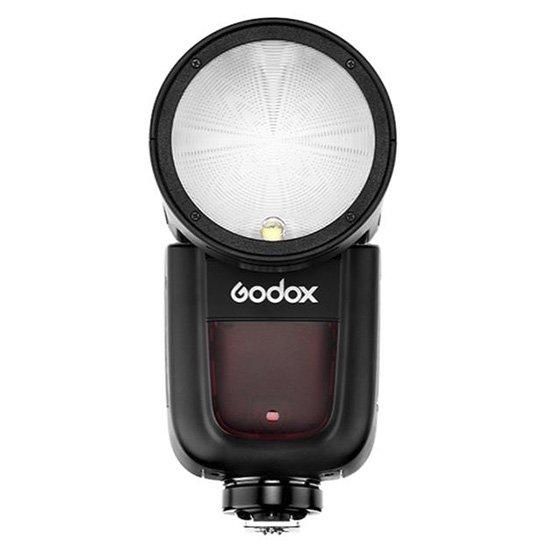

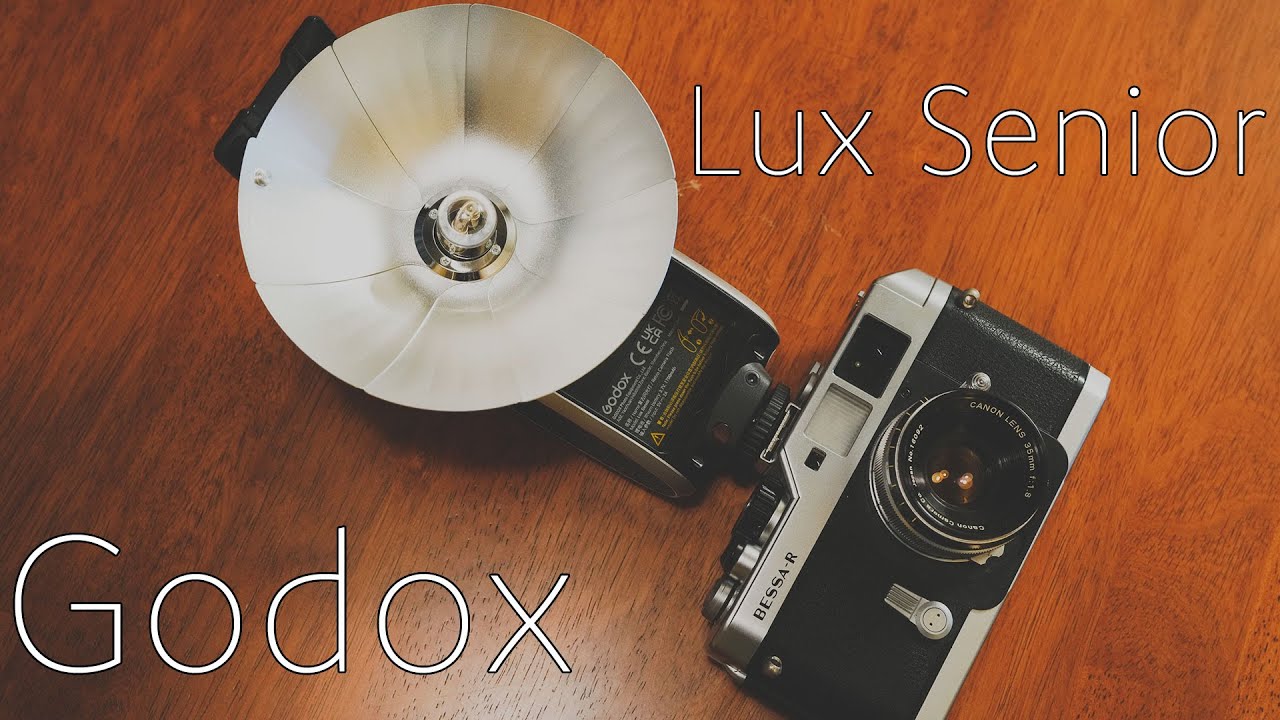

Lux Senior 11月25日 発売予約受付

7779円GODOX Lux Junior クリップオンフラッシュ(KPI正規輸入品)テレビ、オーディオ、カメラカメラAmazon | Godox Lux Junior レトロカメラフラッシュ 自動フラッシュと

GODOX Lux Junior:

1980年代を思わせるレトロでスタイリッシュなデザインで、コンパクトサイズ。

いつでも、どこにでも持って行きたくなるカメラフラッシュです。

簡単な操作で、オートフラッシュモード(Aモード)、マニュアルフラッシュモード(Mモード)の切り替えが可能。

またMモードでは、光制御機能(S1/S2)をお使いいただけます。

GN:12(フル発光時/ISO100/m)で、出力は7段階(1/1〜1/64)です。

電源は単4形のニッケル水素充電池またはアルカリ乾電池を使用します。

本体サイズ/重量:73.8×50.2×71.8mm/130g

KPI正規輸入品で1年の保証と、メンテナンス対応です。GODOX Lux Junior クリップオンフラッシュ(KPI正規輸入品

GODOX Lux Junior クリップオンフラッシュ(KPI正規輸入品

GODOX Lux Junior クリップオンフラッシュ(KPI正規輸入品

Godox Lux Junior クリップオンフラッシュ(KPI正規輸入品) - 写真

Godox Lux Junior クリップオンフラッシュ(KPI正規輸入品) - 写真

GODOX Lux Junior クリップオンフラッシュ(KPI正規輸入品

Godox Lux Junior クリップオンフラッシュ(KPI正規輸入品) - 写真

Godox Lux Junior クリップオンフラッシュ(KPI正規輸入品) - 写真

Godox Lux Junior レトロカメラフラッシュ 自動フラッシュと手動フラッシュモード付き キヤノン、ニコン、富士、オリンパス、ソニーなど、さまざまなカメラと互換性があります

Amazon | 【国内正規品】 GODOX Photo Equipment カメラクリップオン

GODOXのLuxシリーズ売場 - kktpc web shop

Godox Lux ジュニア レトロ カメラ フラッシュ ストロボ スピードライト

KPI/レトロなデザインのカメラフラッシュ GODOX「Lux Senior」と「Lux

Amazon | 【国内正規品】 GODOX Photo Equipment カメラクリップオン

GODOX 各種カタログ、対応表のページ

KPI/レトロなデザインのカメラフラッシュ GODOX「Lux Senior」と「Lux

ゴドックス(GODOX) | KPI - (株)ケンコープロフェショナルイメージング

Godox ラックスシニア lux senior クリップオンストロボ-

Godox「Lux Junior」カラーバリエーション | KPI - (株)ケンコー

Amazon | Godox Lux Junior レトロ カメラフラッシュ クリップオン

取寄】 Lux Junior カラーバリエーション ピンク カメラフラッシュ

福袋セール Amazon 楽天市場】Godox クリップオン Godox Lux Lux

GODOX 各種カタログ、対応表のページ

GODOX ストロボ・大型ストロボ・ライトスタンド・ソフトボックス一覧

GODOXモノブロッククリップオンストロボを特価で販売 - kktpc web shop

Godox ラックスシニア lux senior クリップオンストロボ-

Amazon | Godox Lux Junior レトロカメラフラッシュ 自動フラッシュと

外付けフラッシュのおすすめ】初心者もカメラ沼住人も欲しくなる

楽天市場】\楽天上位1%の安心優良ストア/Godox Lux Junior レトロ

GODOX 各種カタログ、対応表のページ

取寄】 Lux Junior カラーバリエーション ピンク カメラフラッシュ

楽天市場】\楽天上位1%の安心優良ストア/Godox Lux Junior レトロ

Godox Lux ジュニア レトロ カメラ フラッシュ ストロボ スピードライト

Godox ラックスシニア lux senior クリップオンストロボ-

Lux Junior | GEARHOLICオンラインショップ

Godox「Lux Junior」カラーバリエーション | KPI - (株)ケンコー

GODOXモノブロッククリップオンストロボを特価で販売 - kktpc web shop

ヨドバシ.com - 5ページ目 クリップオンストロボ 通販【全品無料配達】

Godox ラックスシニア lux senior クリップオンストロボ-

楽天市場】\楽天上位1%の安心優良ストア/Godox Lux Junior レトロ

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています