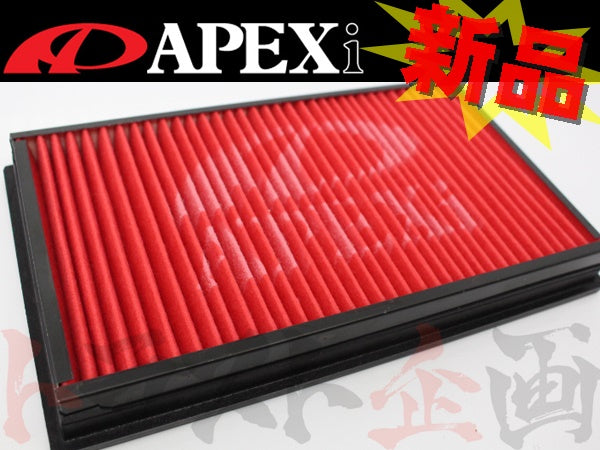

即納 APEXi アペックス エアクリ アリスト JZS147 2JZ-GTE パワーインテーク 507-T010 トヨタ (126121073

(税込) 送料込み

商品の説明

商品情報

商品名:パワーインテーク

11827円即納 APEXi アペックス エアクリ アリスト JZS147 2JZ-GTE パワーインテーク 507-T010 トヨタ (126121073車、バイク、自転車自動車Yahoo!オークション -「apexi パワーインテーク」(パーツ) の落札相場

メーカー:トヨタ

車種:アリスト

型式:JZS147

エンジン型式:2JZ-GTE

年式:91/10-97/07

部品番号:507-T010

【ご注意!】

ご購入前に必ずパソコン版 商品説明をご確認ください。

複数商品をご注文頂きますと、送料が自動計算となってしまいます。

こちらで適切な同梱後の送料に変更させて頂き決済・ご入金の案内をさせていただきます。

APEX,APEXi,apex,アペックス,POWER,INTAKE,パワー,インテーク,エアクリ,エアー,エア,クリーナー,コア,タイプ,コアタイプ,剥き出し,特殊,素材,乾式,湿式,メンテナンス,フリー,純正,交換,吸気効率,デュアル,ファンネル,構造,デュアルファンネル,エアフローメータ,ダスト,,,トラスト企画APEXi アペックス エアクリ アリスト JZS147 2JZ-GTE パワーインテーク

APEXi アペックス エアクリ アリスト JZS147 2JZ-GTE パワーインテーク

Yahoo!オークション - 即納 APEXi アペックス エアクリ アリスト JZS1...

APEXi アペックス エアクリ アリスト JZS147 2JZ-GTE パワーインテーク

APEXi アペックス エアクリ アリスト JZS147 2JZ-GTE パワーインテーク

アペックス パワーインテーク 507T010 トヨタ アリスト JZS147 2JZGTE

アペックス パワーインテーク 507T010 トヨタ アリスト JZS147 2JZGTE

アペックス パワーインテーク 507T010 トヨタ アリスト JZS147 2JZGTE

アペックス パワーインテーク 507T010 トヨタ アリスト JZS147 2JZGTE

Yahoo!オークション -「アペックスパワーインテーク」の落札相場・落札価格

パワーインテークのYahoo!オークション(旧ヤフオク!)の相場・価格を

Yahoo!オークション -「apexi パワーインテーク」(パーツ) の落札相場

数量限定・即納特価!!-ブリッツ アドバンス•パワー エアク•リーナー

数量限定・即納特価!!-ブリッツ アドバンス•パワー エアク•リーナー

APEXi アペックス エアクリ チェイサー JZX100 1JZ-GE パワーインテーク 508-T023 トラスト企画 トヨタ (126121095

パワーインテークのYahoo!オークション(旧ヤフオク!)の相場・価格を

数量限定・即納特価!!-ブリッツ アドバンス•パワー エアク•リーナー

Yahoo!オークション -「apexi パワーインテーク」(パーツ) の落札相場

超安値登場! APEXi アペックス エアクリ アリスト JZS147 2JZ-GTE

2024年最新】Yahoo!オークション -アリスト エアクリの中古品・新品

Amazon | A'PEXi(アペックス)パワーインテーク ミツビシ GH-CT9A 507

数量限定・即納特価!!-ブリッツ アドバンス•パワー エアク•リーナー

Apexi パワーインテーク のパーツレビュー | マークII(かろっと

Apexi パワーインテーク のパーツレビュー | スープラ(cockpit) | みんカラ

APEXi パワーインテーク ##126121073 – トラスト企画オンラインショップ

パワーインテークのYahoo!オークション(旧ヤフオク!)の相場・価格を

Yahoo!オークション -「apexi パワーインテーク」(パーツ) の落札相場

2024年最新】2JZ-GTE アリスト エンジンの人気アイテム - メルカリ

2024年最新】2JZ-GTE アリスト エンジンの人気アイテム - メルカリ

Amazon | A'PEXi(アペックス)パワーインテーク ニッサン #S14/S15 507

数量限定・即納特価!!-ブリッツ アドバンス•パワー エアク•リーナー

APEXi パワーインテーク ##126121073 – トラスト企画オンラインショップ

2024年最新】Yahoo!オークション -アリスト エアクリの中古品・新品

ニスモタービンをツイン武装した漢のJZS147アリスト!」500馬力の超

数量限定・即納特価!!-ブリッツ アドバンス•パワー エアク•リーナー

2024年最新】2JZ-GTE アリスト エンジンの人気アイテム - メルカリ

車用エアクリーナー S15 アペックスの人気商品・通販・価格比較 - 価格.com

Apexi パワーインテーク のパーツレビュー | カローラランクス(しょー

Yahoo!オークション -「)アリストjzs147」の落札相場・落札価格

TOYOTA アリスト JZS147 1991年10月〜1997年08月 2JZ-GTE - TRUST

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています