Cold Air Intake System with Heat Shield Kit + Filter Combo RED Compatible For 11-14 Ford F150 5.0L V8

(税込) 送料込み

商品の説明

商品情報

全国送料無料。海外倉庫から国内に取り寄せますので、お届けまで2-3週間程度お時間頂いております。また、税関審査により、開封による外箱の損傷の可能性が稀にございますが、商品自体の品質は問題ございませんのでご安心ください。国内到着後に一度検品して発送させて頂きます。商品についてご不明な点がございましたら、「この商品について問い合わせ」ボタンからお気軽にお問い合わせください。(商品が電波法上の技術基準に適合する必要がある無線機器の場合:商品は並行輸入品でございますので、電波法上の技術基準に適合いたしません。日本国内で使用すると電波法に違反するおそれがありますのでご購入、ご使用には十分ご注意ください)

22165円Cold Air Intake System with Heat Shield Kit + Filter Combo RED Compatible For 11-14 Ford F150 5.0L V8車、バイク、自転車自動車Cold Air Intake System with Heat Shield Kit + Filter Combo BLUECold Air Intake System with Heat Shield Kit + Filter Combo RED Compatible For 11-14 Ford F150 5.0L V8

Cold Air Intake System with Heat Shield Kit + Filter Combo RED Compatible For 15-20 Ford F150 5.0L V8

Cold Air Intake System with Heat Shield Kit + Filter Combo RED Compatible For 15-20 Ford F150 5.0L V8

Cold Air Intake System with Heat Shield Kit + Filter Combo RED

Cold Air Intake System with Heat Shield Kit + Filter Combo BLACK Compatible For 15-20 Ford F150 5.0L V8

4

3.5

Cold Air Intake System with Heat Shield Kit + Filter Combo BLUE Compatible For 09-10 Ford F150 / 07-14 Ford Expedition/Lincoln Navigator 5.4L V8

Cold Air Intake System with Heat Shield Kit + Filter Combo RED

3.5

Amazon.com: High Performance Parts Heat Shield Cold Air Intake Kit

Cold Air Intake System with Heat Shield Kit + Filter Combo RED

Amazon.com: High Performance Parts Heat Shield Cold Air Intake Kit

Amazon.com: High Performance Parts Heat Shield Cold Air Intake Kit

3.5

Cold Air Intake System with Heat Shield Kit + Filter Combo RED

Amazon.com: Cold Air Intake System with Heat Shield Kit + Filter

Compatible For 15-20 Ford F150 5.0L V8 Cold Air Intake System with Heat Shield Kit + Filter Combo BLUE

3.5

Cold Air Intake System with Heat Shield Kit + Filter Combo BLUE Compatible For 11-14 Ford F150 5.0L V8

Ares RED 11-14 Ford F150 5.0L V8 Heat Shield Cold Air Intake + Filter

aosu red cold air intake +| Alibaba.com

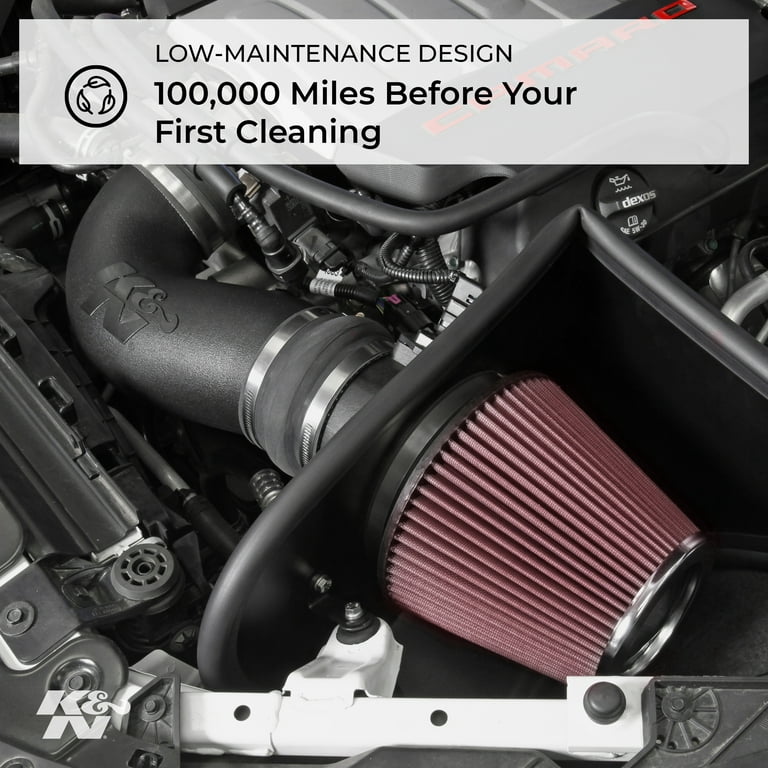

K&N Cold Air Intake Kit: High Performance, Guaranteed to Increase

Ares RED 11-14 Ford F150 5.0L V8 Heat Shield Cold Air Intake + Filter

Ares RED 11-14 Ford F150 5.0L V8 Heat Shield Cold Air Intake + Filter

Cold Air Intake System with Heat Shield Kit + Filter Combo BLUE

3.5

K&N 11-14 Ford F-150 5.0L V8 Performance Intake Kit

3.5

K&N 11-14 Ford F-150 5.0L V8 Performance Intake Kit

3.5

Ares RED 11-14 Ford F150 5.0L V8 Heat Shield Cold Air Intake + Filter

Red Cold Air Intake System AHI-RL-FD06RD for 11-14 Mustang 5.0L V8

HPS Performance Red Shortram Air Intake Kit + Heat Shield Cool

Ares RED 11-14 Ford F150 5.0L V8 Heat Shield Cold Air Intake + Filter

HPS Performance Red Shortram Air Intake with Heat Shield

Performance Aluminum Heat Shield Cold Air Intake System For 2015

K&N Cold Air Intake Kit: High Performance, Guaranteed to Increase

3.5

F150 Cold Air Intake

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています