シンワ測定 デジタル塩分濃度計 72799 1本 (メーカー直送)

(税込) 送料込み

商品の説明

商品情報

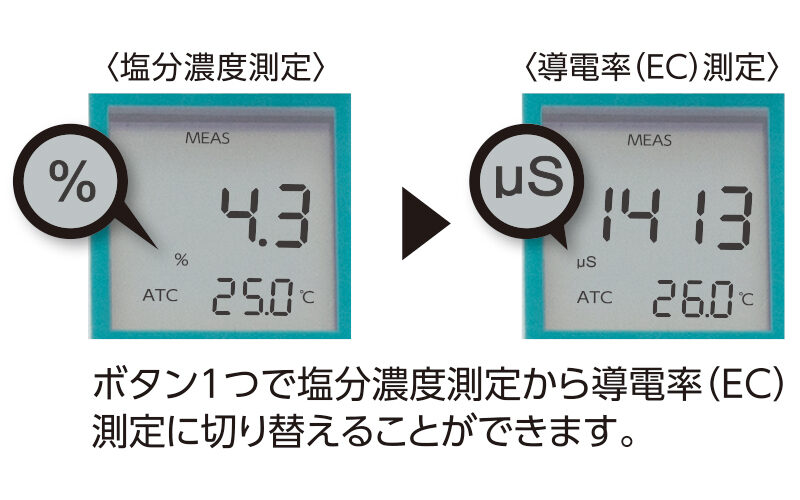

メーカー:シンワ測定品番:72799導電率(EC)測定機能付

12920円シンワ測定 デジタル塩分濃度計 72799 1本 (メーカー直送)DIY、工具道具、工具シンワ測定 デジタル塩分濃度計 品番:72799 : shinwa-72799たのめーる】シンワ測定 デジタル塩分濃度計 72799 1本の通販

デジタル塩分濃度計 72799 シンワ測定 (直送品)

デジタル塩分濃度計 72799 シンワ測定 (直送品)

デジタル塩分濃度計 72799 シンワ測定 (直送品)

デジタル塩分濃度計 72799 シンワ測定 (直送品)

デジタル塩分濃度計 72799 シンワ測定 (直送品)

シンワ デジタル塩分濃度計 72799 ホールド機能・自動温度補償(ATC

楽天市場】シンワ測定 72799 デジタル塩分濃度計 : 瀧商店

72799/デジタル塩分濃度計

Amazon.co.jp: シンワ測定(Shinwa Sokutei) デジタル塩分濃度計 72799

デジタル塩分濃度計 72799 シンワ測定 環境測定器|au PAY マーケット

デジタル塩分濃度計 - シンワ測定株式会社

Amazon.co.jp: シンワ測定(Shinwa Sokutei) デジタル塩分濃度計 72799

デジタル塩分濃度計 72799 シンワ測定 (直送品)

デジタル塩分濃度計 72799 シンワ測定 環境測定器の通販はau PAY

シンワ デジタル塩分濃度計 72799 / 環境測定器 / シンワ 測定機器

楽天市場】デジタル塩分濃度計 ※取寄品 シンワ 72799 : 大工道具・金物

デジタル塩分濃度計 - その他

デジタル塩分濃度計 - その他

デジタル塩分濃度計 72799 シンワ測定 環境測定器の通販はau PAY

デジタル塩分濃度計 72799 シンワ測定 (直送品)

楽天市場】デジタル塩分濃度計 ※取寄品 シンワ 72799 : 大工道具・金物

Amazon.co.jp: シンワ測定(Shinwa Sokutei) デジタル塩分濃度計 72799

デジタル塩分濃度計 72799 シンワ測定 (直送品)

楽天市場】シンワ測定 デジタル塩分濃度計 72799 直径40×185mm シンワ

デジタル塩分濃度計 72799 シンワ測定 環境測定器の通販はau PAY

シンワ測定 デジタル塩分濃度計 品番:72799 : shinwa-72799

デジタル塩分濃度計 - その他

エスコ デジタル塩分濃度計 EA776BB-11 1個(直送品) - アスクル

デジタル塩分濃度計 - シンワ測定株式会社

結婚祝い シンワ デジタル塩分濃度計 <72799> - DIY・工具

直売割 FUSO YK-31SA デジタル塩分濃度計 YK31SA - DIY・工具

デジタル塩分計 SA02 カスタム|CUSTOM 通販 | ビックカメラ.com

デジタル塩分濃度計 - その他

Amazon.co.jp: シンワ測定(Shinwa Sokutei) デジタル塩分濃度計 72799

デジタル塩分濃度計 | 温度計・湿度計・環境測定器,環境測定器

デジタル塩分濃度計 72799 シンワ その他 | ホームセンター通販はDCM

楽天市場】シンワ測定 デジタル塩分濃度計 72799 (測定範囲0~8.0

シンワ測定 72799 デジタル塩分濃度計 : haya0240 : ザ・タッキーYahoo

デジタル塩分濃度計 72799 シンワ測定 環境測定器の通販はau PAY

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています

.jpg)