■TRUSCO 軽量150型背側板付棚 1200X300XH2100 5段 TLA74K25(2834171)[法人・事業所限定][直送元]

(税込) 送料込み

商品の説明

商品情報

■商品番号・規格:TLA74K25

28050円■TRUSCO 軽量150型背側板付棚 1200X300XH2100 5段 TLA74K25(2834171)[法人・事業所限定][直送元]家具、インテリアオフィス家具item-shopping.c.yimg.jp/i/n/you-new_ds-1954210_1_d...

■取寄せ品:発送目安7〜10日(土日祝除く)●商品の納期表示について

[ 在庫品 ] 表記 : 当店在庫品

[ 取寄せ ] 表記 : メーカー在庫有時の発送目安となります。TRUSCO 軽量棚背板・側板付き 幅1500×奥行450×高さ2100mm 5段

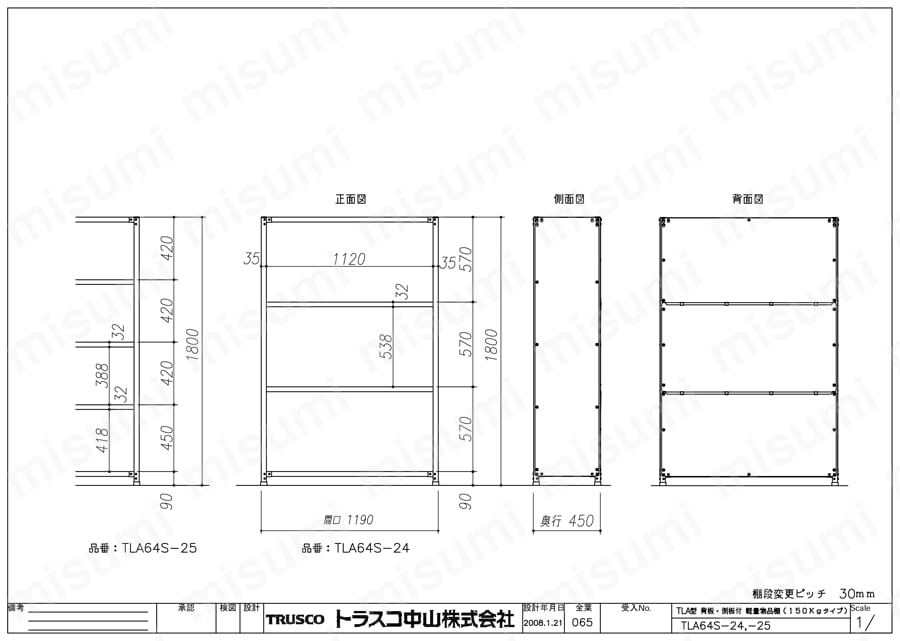

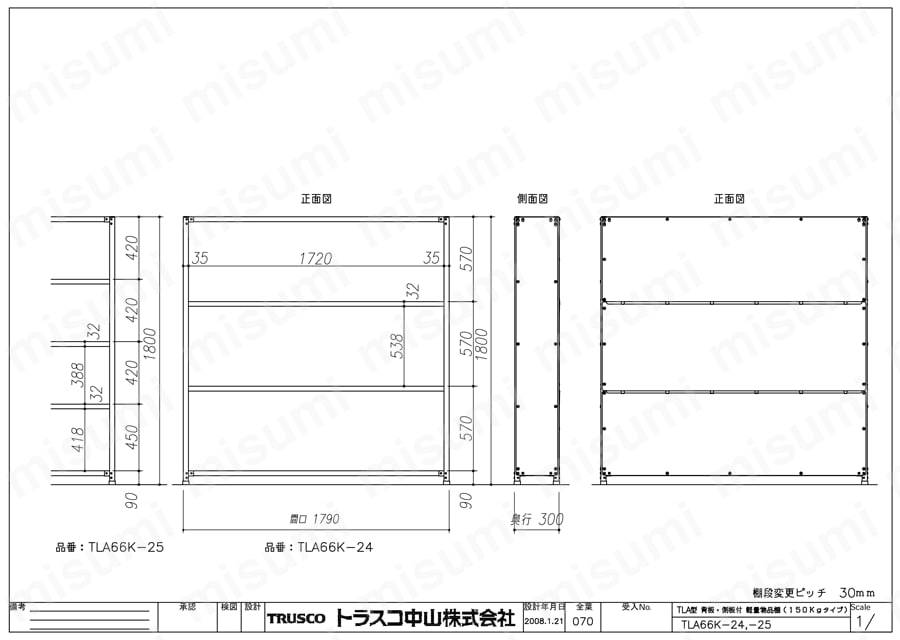

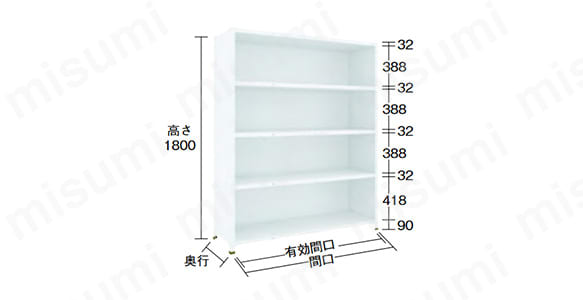

軽中量棚 TLA型 (背板・側板付・150kgタイプ、高さ1800mm) | トラスコ

Amazon.co.jp: TRUSCO 軽量150型背側板付棚

TRUSCO 軽量棚背板・側板付き 幅1500×奥行450×高さ2100mm 5段

TRUSCO 軽量150型背側板付棚 1800X600XH2100 6段 TLA76L26 [TLA76L-26][r21][s9-034]

TRUSCO 軽量棚背板・側板付き 幅1200×奥行600×高さ1800mm 4段

TRUSCO 軽量棚背板・側板付き 幅1500×奥行450×高さ2100mm 5段

TLA43S78 軽量150型背引出付棚900×450×H1200実段7 TRUSCO 引き出し(小

軽中量棚 TLA型 (背板・側板付・150kgタイプ、高さ1200mm)

楽天市場】TRUSCO スチールラック 軽量棚背板・側板付

楽天市場】TRUSCO スチールラック 軽量棚背板・側板付

軽中量棚 TLA型 (背板・側板付・150kgタイプ、高さ1800mm) | トラスコ

TRUSCO 軽量棚背板・側板付 1500X300XH2100 4段

大人気新品 OKUTANI 鉄パンチングメタル 2

軽中量棚 TLA型 (背板・側板付・150kgタイプ、高さ1800mm) | トラスコ

正規通販店舗 コクヨ 品番NLK-10E2 ロッカー Cfort 多人数用

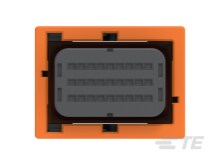

5-1897141-2 : Automotive Housings | TE Connectivity

battery cabinet evo dsp plus modular 42u x 40 mod. batt.

5-1897141-2 : Automotive Housings | TE Connectivity

無休で毎日注文中!】 【P5倍】VETEMENTS / ヴェトモン : DESTROYED

軽中量棚 TLA型 (背板・側板付・150kgタイプ、高さ1800mm) | トラスコ

48141 - rear connection downside vertical mounting - for NW 40..50

TNX_PQPC-0202.JPG

Dettaglio

item-shopping.c.yimg.jp/i/n/pennylane2022_b00uy46j...

2024超話題新作 【設置無料】 スチールラック 3段 幅940×奥行450×高さ

item-shopping.c.yimg.jp/i/n/you-new_ds-1954210_1_d...

伸縮 つっぱり棒用棚板 L タワー tower つっぱり棚用 伸縮 5322 5323

TPT-K3234C-BK プラスチック棚 軽量型・棚板間隔高さ250mmタイプ 1台

で公式に取扱 TRUSCO 軽量150型背側板付棚

5-1897141-2 : Automotive Housings | TE Connectivity

TRUSCO プラ棚用 棚板セット軽量型 脚付 800X350_ の

2024超話題新作 【設置無料】 スチールラック 3段 幅940×奥行450×高さ

5-1897141-2 : Automotive Housings | TE Connectivity

Dettaglio

軽中量棚 TLA型 (背板・側板付・150kgタイプ、高さ1800mm) | トラスコ

5-1897141-2 : Automotive Housings | TE Connectivity

超安い BV04376 タンガロイ 転削用K.M級TACチップ COAT 【10入】 【10

11041715 - Bosch Control Board Module | Parts Dr

11041715 - Bosch Control Board Module | Parts Dr

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています