アルミ 丸棒 A5052BE-H112 180mm 長さ270mm

(税込) 送料込み

商品の説明

商品情報

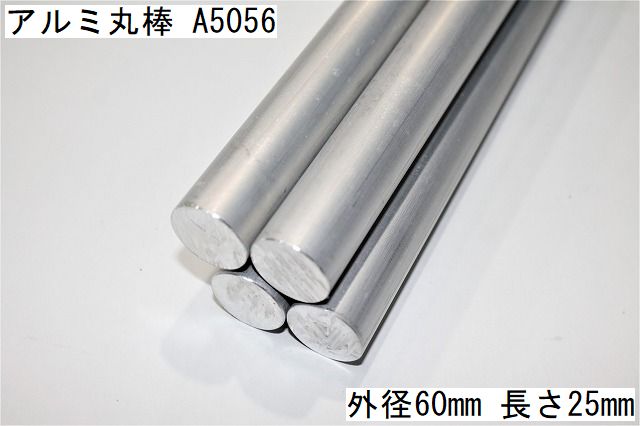

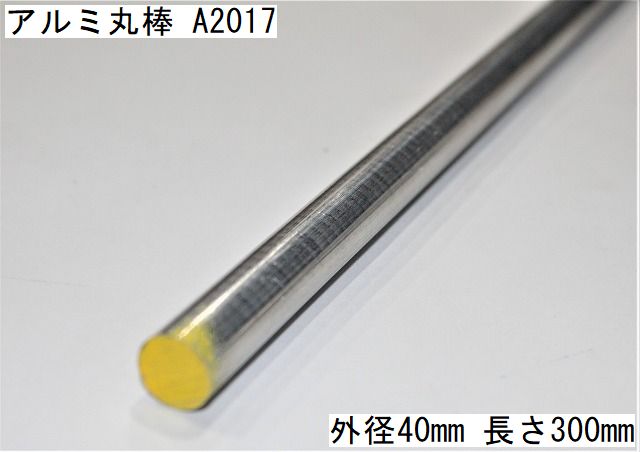

■材質: A5052

24622円アルミ 丸棒 A5052BE-H112 180mm 長さ270mmDIY、工具材料、部品アルミ 丸棒 A5056BE-H112 120mm 長さ650mm - 材料、部品

中程度の強度を持つ、最も代表的なAl-Mg(5000系)合金。耐海水性に優れているため船舶用部材に使用され、また溶接性が良好なことから溶接構造材として使用されています。

■調質: H112

展伸材においては積極的な加工硬化を加えずに、製造したままの状態で機械的性質の保証がされたもの。

■主な用途

工作材・機械材・建築材・船舶用部材・車軸用部材・カメラ鏡銅・DIY

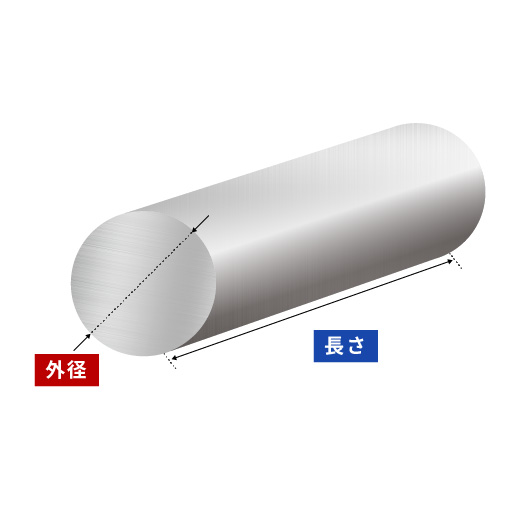

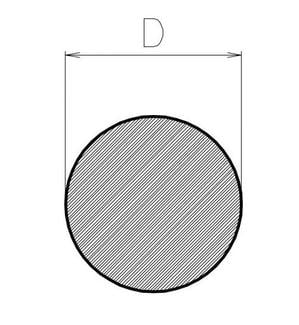

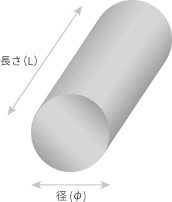

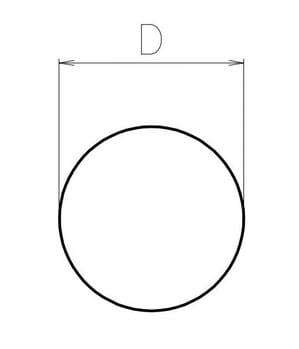

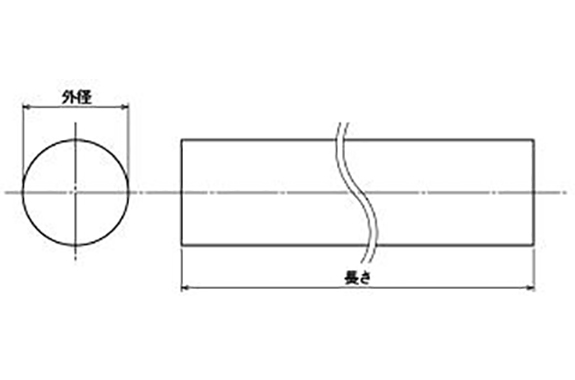

■サイズ

[D]180mm×270mm

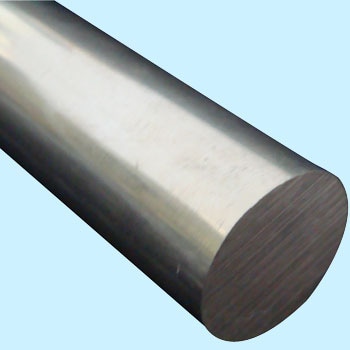

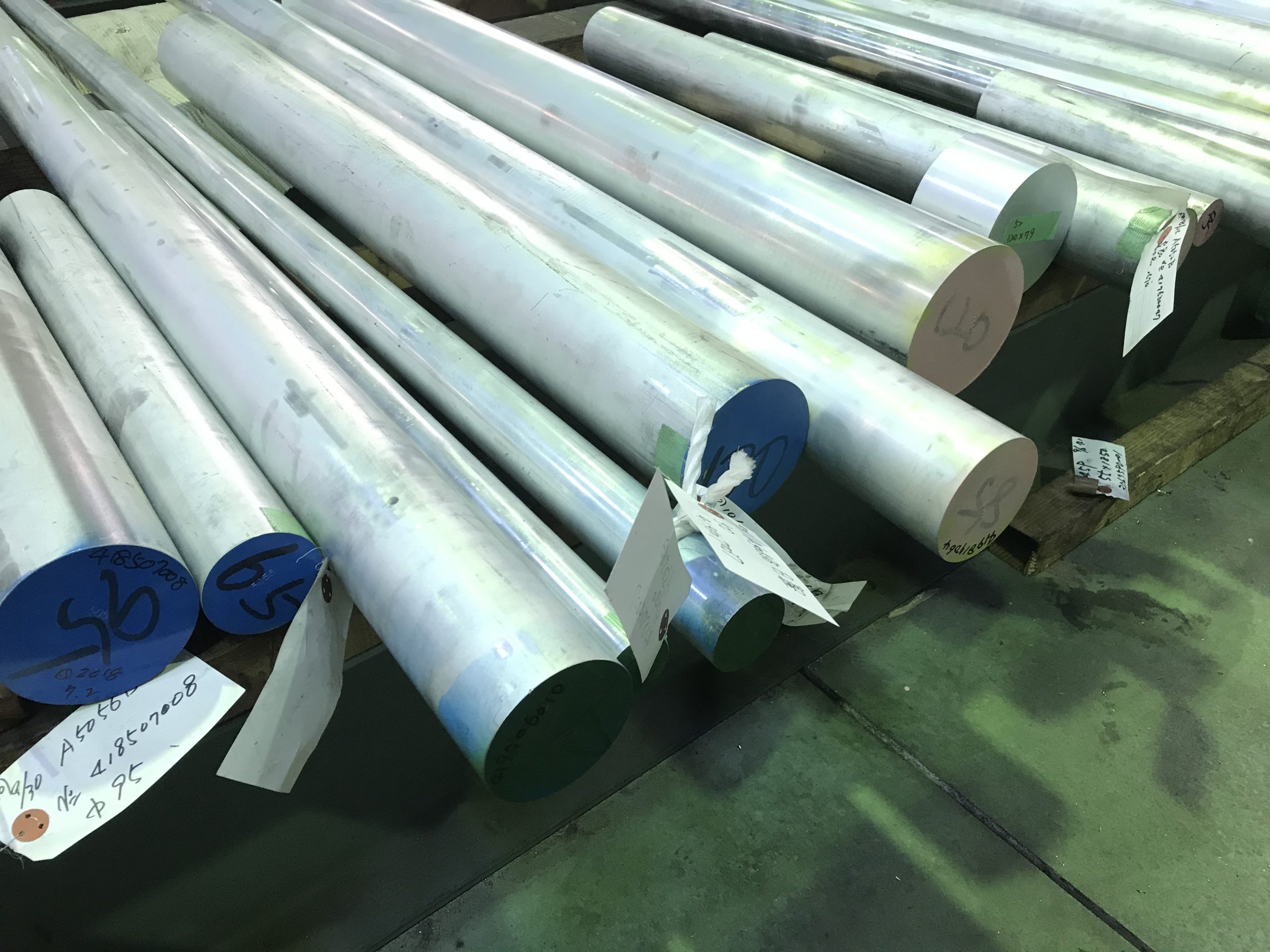

※写真はサンプル画像です。

用途多数のアルミ材料を1本からご提供致します。 在庫は、良く出るものは数トン単位で在庫がございます。

別途、アルマイト処理や受注生産品をご希望の方は、お気軽にお問い合わせください。アルミ 丸棒 A2017BE-T4 270mm 長さ140mm - 材料、部品

アルミ 丸棒 A5056BE-H112 120mm 長さ650mm - 材料、部品

配送ネットワーク アルミ 丸棒 A5052BE-H112 180mm 長さ790mm - 材料、部品

アルミ丸棒(A5052) 外径42Φmm 1本 ノーブランド 【通販サイトMonotaRO】

アルミ 丸棒 A5052BE-H112 90mm 長さ760mm - 材料、資材

アルミ丸棒|アルミ合金A5052B の切り売り販売は非鉄金属ドットコムへ

アルミ 丸棒 A5052BE-H112 180mm 長さ295mm 保証期間 材料、資材

アルミ 丸棒 A5056BE-H112 190mm 長さ165mm :a5056be-h112-b-190-165

アルミ 丸棒 A5056BE-H112 110mm 長さ570mm - 材料、部品

アルミ丸棒|アルミ合金A5052B の切り売り販売は非鉄金属ドットコムへ

国内在庫】 アルミ 丸棒 A5052BE-H112 180mm 長さ790mm - 材料、部品

アルミ 丸棒 A5056BE-H112 190mm 長さ165mm :a5056be-h112-b-190-165

アルミ 丸棒 A5056BE-H112 120mm 長さ650mm - 材料、部品

アルミ 丸棒 A5052BE-H112 180mm 長さ245mm-

アルミ 丸棒 A5056BE-H112 190mm 長さ165mm :a5056be-h112-b-190-165

アルミ 丸棒 A5056BE-H112 140mm 長さ360mm - 材料、部品

アルミ 2017押出丸棒 直径37mm 50 mm - 通販 - escopil.co.mz

アルミ 丸棒 A5052BE-H112 150mm 長さ480mm-

アルミ 丸棒 A5056BE-H112 350mm 長さ270mm-

アルミ 丸棒 A5052BE-H112 90mm 長さ760mm - 材料、資材

A5052 アルミ丸棒】のおすすめ人気ランキング - モノタロウ

楽天市場】アルミ A5052 丸棒 外径5mm 長さ1000mm 引抜 52S オーダー

アルミ 棒 A5052|生井金属株式会社(公式ホームページ)

アルミ 丸棒 A5052BE-H112 90mm 長さ760mm - 材料、資材

アルミ 丸棒 A5056BE-H112 190mm 長さ165mm :a5056be-h112-b-190-165

アルミ 丸棒 A5052BE-H112 180mm 長さ245mm-

アルミ 丸棒 A5056BE-H112 120mm 長さ650mm - 材料、部品

楽天市場】アルミ A5052 丸棒 外径5mm 長さ1000mm 引抜 52S オーダー

プラスチック PI-べスペル SP-1 丸棒(茶) 直径 11.1mm 240 mm-

アルミニウム丸棒5000系【株式会社カネヒロ】アルミニウムの素材から

アルミ 丸棒 A5052BE-H112 150mm 長さ480mm-

アルミ 丸棒 A5056BE-H112 120mm 長さ650mm - 材料、部品

アルミ丸棒 A5052 | アルミ丸棒 A5052 | 【工具と金属材料の通販

アルミ 丸棒 A5052BE-H112 90mm 長さ760mm - 材料、資材

アルミ 棒 A5052|太和黄銅株式会社(公式ホームページ)

アルミ 丸棒 A5056BE-H112 120mm 長さ650mm - 材料、部品

アルミ 丸棒 A5052BE-H112 200mm 長さ140mm-

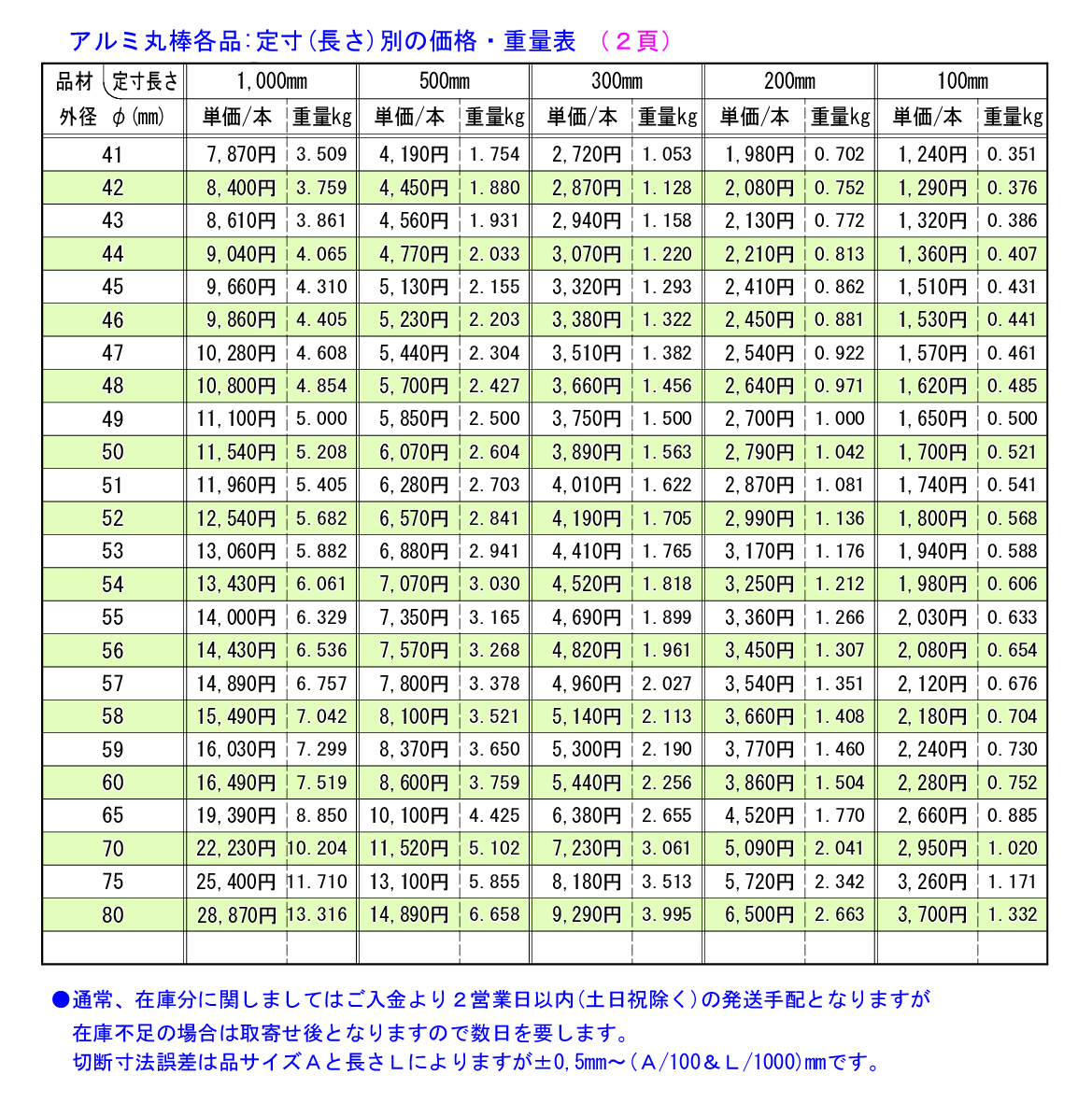

アルミ丸棒販売(切り売り)規格表 | アルミ丸棒販売 アルミテック

アルミ 2017押出丸棒 直径37mm 50 mm - 通販 - escopil.co.mz

プラスチック PI-べスペル SP-1 丸棒(茶) 直径 11.1mm 240 mm-

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています